Last Update 01 Nov 25

Fair value Increased 6.22%Kymera Therapeutics’ analyst price target has increased from $65 to approximately $69, as analysts cite strengthening conviction in the company's KT-621 program and positive upcoming clinical milestones as key drivers for the higher outlook.

Analyst Commentary

Recent assessments by street analysts show growing optimism surrounding Kymera Therapeutics, particularly regarding the advancement and potential of its KT-621 program. Multiple price target increases and favorable ratings reflect strengthened conviction in the company's execution and expected clinical readouts.

Bullish Takeaways

- Bullish analysts see Kymera's KT-621 program driving significant valuation upside. They cite compelling early clinical data and the potential for positive efficacy signals in atopic dermatitis.

- Peak adjusted sales estimates for KT-621 have risen, with some projecting up to $2.6 billion in risk-adjusted worldwide sales by 2035. This supports higher price targets.

- Transition to Phase 2 studies and imminent Phase 1b data readouts are viewed as key catalysts that could further de-risk the program and unlock shareholder value.

- The ongoing progress of KT-621, especially as it advances through critical clinical milestones, is expected to remain a core value driver for the company in the near and long term.

Bearish Takeaways

- Despite raising price targets, some analysts remain cautious and emphasize that valuation is tied to proof-of-concept clinical data yet to be disclosed.

- Uncertainty remains around the magnitude and durability of KT-621's efficacy signals, which could impact future sales estimates and overall investor confidence.

- Potential execution risks exist during the transition between clinical phases. Successful data readouts are needed to justify continued bullishness and further rerating of the stock.

What's in the News

- Kymera presented new preclinical data on KT-579 showing disease-modifying activity across multiple immuno-inflammatory diseases, including lupus and rheumatoid arthritis, at the American College of Rheumatology Annual Meeting in Chicago. (Key Developments)

- Preclinical studies of KT-579 demonstrated significant reductions in markers of lupus progression, including blood interferon-stimulated genes, serum autoantibodies, and kidney IgG deposition. These findings suggest robust efficacy. (Key Developments)

- Positive Phase 1 clinical trial results for KT-621, Kymera's oral STAT6 degrader, will be featured in late-breaking oral presentations at major European dermatology and respiratory congresses. (Key Developments)

- KT-621 achieved rapid, deep, and prolonged STAT6 degradation in both blood and skin. Biomarker reductions matched or surpassed dupilumab and the treatment showed a favorable safety profile in healthy volunteers. (Key Developments)

- Two Phase 2b studies for KT-621 in atopic dermatitis and asthma are planned to initiate from late 2025 into 2026, advancing its development across dermatology, gastroenterology, and respiratory indications. (Key Developments)

Valuation Changes

- Consensus Analyst Price Target has increased from $65 to approximately $69. This reflects a moderate upward revision in expected fair value.

- Discount Rate has risen slightly from 6.85% to 6.94%. This indicates a marginal increase in perceived risk or capital costs.

- Revenue Growth outlook has shifted from a decline of -0.15% to a projected increase of 0.19%, signaling improved sales expectations.

- Net Profit Margin remains virtually unchanged, edging up from 16.38% to 16.40%.

- Future Price-to-Earnings (P/E) ratio has increased from 946x to 996x. This suggests higher anticipated earnings or valuation multiples applied to future profits.

Key Takeaways

- Advancing clinical programs and strategic partnerships could increase market share and positively impact future revenue and earnings.

- Solid cash runway supports focused R&D investments, potentially boosting long-term growth without immediate financing pressures.

- High R&D expenses and reliance on partnerships pose risks to Kymera's long-term financial health and ability to maintain a leadership position in their sector.

Catalysts

About Kymera Therapeutics- Together with its subsidiary, a clinical-stage biopharmaceutical company, focuses on discovering and developing small molecule therapeutics that selectively degrade disease-causing proteins by harnessing the body’s own natural protein degradation system.

- Kymera Therapeutics plans to advance its STAT6 and TYK2 programs into several clinical stages, which could potentially increase future revenue due to the expansion into new treatment markets and therapeutic areas.

- The anticipated Phase II and III trials for their immunology pipeline aim to deliver biologics-like efficacy in oral form, which could enhance net margins by reducing manufacturing costs associated with biologics and potentially capturing a larger market share.

- The collaboration with Sanofi on the IRAK4 program, with expanded Phase II trials, positions Kymera to fast-track toward pivotal trials, potentially accelerating time-to-market and impacting future earnings positively.

- The company's strategy to introduce at least one new IND per year could expand their pipeline steadily, offering opportunities for revenue growth from licensing deals or partnerships.

- With a significant cash runway extending into mid-2027, Kymera can support its R&D activities without immediate pressure for additional financing, allowing focused investment in high-potential programs that could drive long-term earnings growth.

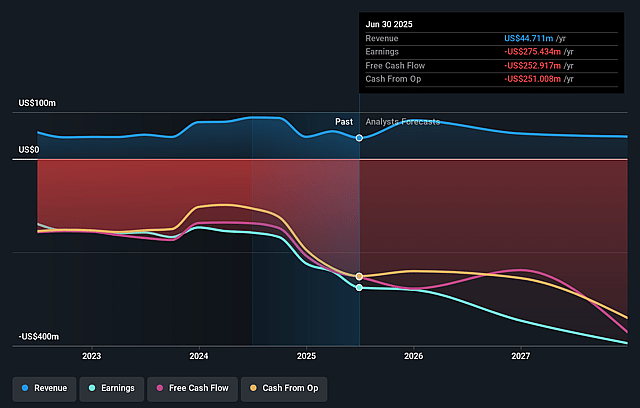

Kymera Therapeutics Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Kymera Therapeutics's revenue will grow by 20.4% annually over the next 3 years.

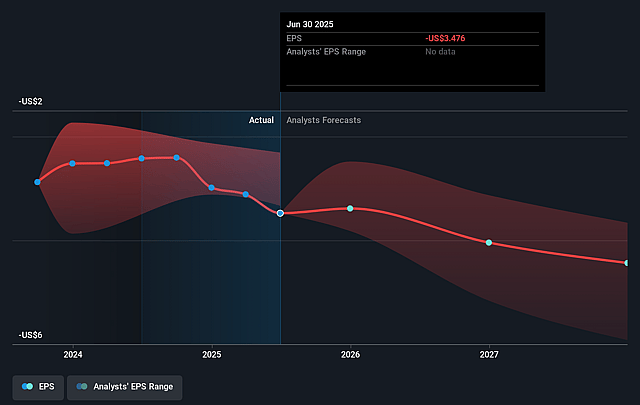

- Analysts are not forecasting that Kymera Therapeutics will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Kymera Therapeutics's profit margin will increase from -475.6% to the average US Biotechs industry of 15.9% in 3 years.

- If Kymera Therapeutics's profit margin were to converge on the industry average, you could expect earnings to reach $13.0 million (and earnings per share of $0.17) by about May 2028, up from $-223.9 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 410.7x on those 2028 earnings, up from -9.8x today. This future PE is greater than the current PE for the US Biotechs industry at 20.4x.

- Analysts expect the number of shares outstanding to grow by 5.84% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.47%, as per the Simply Wall St company report.

Kymera Therapeutics Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The transition to a video format for financial updates may not significantly impact investor perception or the company’s market value, and does not directly address any operational or financial performance issues.

- Competition in the STAT6 space has increased, which may impact Kymera's ability to maintain its leadership position and could affect future revenue streams.

- Although significant progress is being made with partners like Sanofi, reliance on partnerships exposes Kymera to risks if partners face challenges in advancing clinical trials, potentially impacting future earnings.

- The financial performance shows high R&D expenses with $71.8 million spent in the fourth quarter alone, which could strain resources and impact net margins if new drugs don't reach successful commercialization.

- Despite a significant cash balance, the projected cash runway into mid-2027 suggests that sustained high operational costs could pose a risk to long-term financial health if projected clinical milestones or revenue targets are not met.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $57.667 for Kymera Therapeutics based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $97.0, and the most bearish reporting a price target of just $41.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $82.2 million, earnings will come to $13.0 million, and it would be trading on a PE ratio of 410.7x, assuming you use a discount rate of 6.5%.

- Given the current share price of $33.69, the analyst price target of $57.67 is 41.6% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.