Last Update 11 Feb 26

Fair value Increased 2.11%AZZ: Future Fair Value Will Rely On Execution And Measured M&A Plans

Analysts lifted their price target on AZZ to $125 from $120, reflecting updated assumptions around a fair value estimate of $134.33, slight changes in the discount rate and P/E, and modestly higher revenue growth and profit margin inputs following recent internal execution commentary.

Analyst Commentary

Bullish analysts point to recent internal execution as the key driver behind the updated fair value assumptions and the higher price target. The tone around the business model and operating performance is more confident, which feeds directly into the revised revenue and margin inputs used in valuation work.

Bullish Takeaways

- Bullish analysts view the strong internal execution commentary as support for modestly higher revenue and profit margin assumptions in their models, which feeds into the fair value estimate of $134.33.

- The lift in the price target to $125 from $120 is seen as better alignment between the current share price, updated P/E inputs and the refreshed cash flow outlook.

- Analysts see the company’s recent performance against internal expectations as a sign that management is delivering in line with planning, which they factor into a slightly lower perceived execution risk.

- The gap between the $125 price target and the $134.33 fair value estimate is viewed as providing some room for additional upside if the execution trends hold.

Bearish Takeaways

- Bearish analysts keep a Neutral stance, signaling that, even with better execution inputs, they see a balanced risk reward profile at current levels.

- Retention of the Neutral rating suggests caution that the improved revenue growth and margin assumptions may already be reflected in the valuation after the target increase.

- Some analysts appear wary of pushing the target closer to the $134.33 fair value estimate, which hints at concern around the durability of current execution commentary and underlying assumptions.

- The reliance on modest model adjustments to justify the higher target, such as tweaks to the discount rate and P/E, indicates that analysts are not yet ready to reframe the story as a higher growth or higher quality re rating case.

What's in the News

- AZZ issued new sales guidance for the 12 month period ending February 28, 2027, calling for revenue in a range of US$1.725b to US$1.775b. (Corporate guidance)

- The company narrowed its sales guidance for the year ending February 28, 2026 to US$1.625b to US$1.7b. (Corporate guidance)

- The Board of Directors authorized a new share buyback plan on January 30, 2026, in conjunction with a share repurchase program of up to US$100m. (Buyback transaction announcements)

- AZZ reported that between September 1, 2025 and November 30, 2025 it repurchased 201,416 shares for US$20m, bringing total repurchases under the November 12, 2020 authorization to 1,134,067 shares for US$66.81m. (Buyback tranche update)

- Management indicated on the third quarter fiscal 2026 earnings call that AZZ is evaluating several tuck in acquisitions in Metal Coatings and Precoat Metals and described the M&A pipeline as very active. (Seeking acquisitions)

Valuation Changes

- Fair Value: Updated to $134.33 from $131.56, representing a small upward adjustment to the modelled intrinsic value per share.

- Discount Rate: Adjusted slightly to 8.76% from 8.77%, reflecting a minimal change in the rate used to discount future cash flows.

- Revenue Growth: Refined to 5.29% from 5.16%, indicating a modestly higher long term revenue growth assumption.

- Net Profit Margin: Updated to 11.10% from 10.81%, representing a small increase in the expected steady state profitability level.

- Future P/E: Revised to 23.93x from 24.16x, a slight reduction in the valuation multiple applied to forward earnings.

Key Takeaways

- Strategic investments in technology and infrastructure expansion are expected to boost operating efficiency, revenue growth, and elevate net margins.

- AZZ's focus on debt reduction, market share expansion, and infrastructure demand positions it for long-term value enhancement and income margin improvement.

- Adverse weather, tariff uncertainties, competition, new facility execution risks, and acquisition challenges could affect AZZ's operational reliability, margins, and market position.

Catalysts

About AZZ- Provides hot-dip galvanizing and coil coating solutions in North America.

- AZZ's new greenfield facility near St. Louis, Missouri is ramping up production, which could drive future revenue growth as it expands capacity and taps into strong local demand. This investment is expected to positively impact earnings as the facility becomes fully operational and contributes to higher sales volumes.

- AZZ plans to continue strengthening its balance sheet by paying down debt and improving capital allocation, which should reduce interest expenses and enhance net income margins over time as borrowing costs are minimized.

- The company's strategic investments in enterprise-wide technologies, such as enhancing the Digital Galvanizing System (DGS), aim to improve operating productivity and efficiency, which could lead to higher net margins through cost savings and improved operational performance.

- AZZ is actively pursuing bolt-on acquisitions and expanding market share, which are expected to drive revenue growth and operational synergies. This inorganic growth strategy, alongside organic expansion, positions the company to enhance long-term shareholder value and improve net margins.

- The anticipated continuation of infrastructure spending related to the AIIJA program and urbanization trends will likely boost demand for AZZ's services, supporting top-line growth. This sustained strong demand, especially in bridge, highway, transmission, and distribution projects, is expected to positively impact revenue.

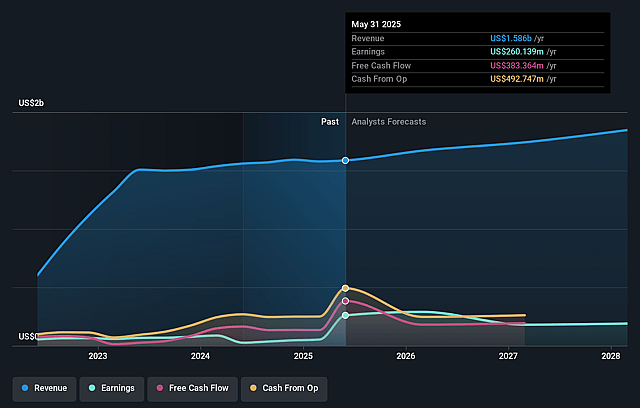

AZZ Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AZZ's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 16.4% today to 10.6% in 3 years time.

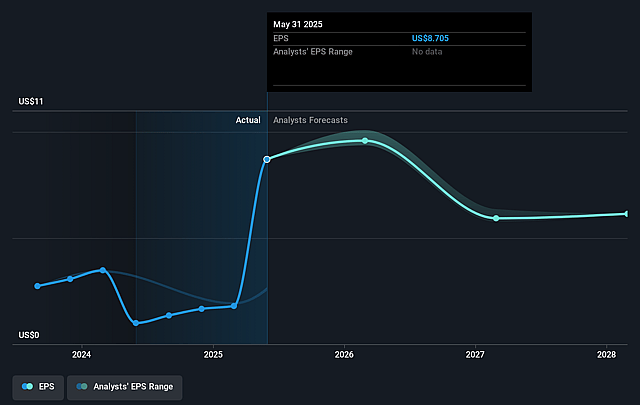

- Analysts expect earnings to reach $195.5 million (and earnings per share of $6.46) by about September 2028, down from $260.1 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 24.7x on those 2028 earnings, up from 13.1x today. This future PE is greater than the current PE for the US Building industry at 23.0x.

- Analysts expect the number of shares outstanding to grow by 0.46% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.49%, as per the Simply Wall St company report.

AZZ Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The fourth quarter results were negatively impacted by adverse weather, leading to over 200 days of lost production, which could affect seasonal earnings reliability in future periods if such conditions persist.

- Uncertainty around tariffs could lead to volatility in the availability and cost of materials, which might impact margins if costs cannot be fully passed on to customers.

- There is potential for increased competition in the U.S. as reshoring trends may bring in new market participants, possibly affecting AZZ's revenue and market share.

- With the ramp-up of new facilities such as the Washington aluminum coil coating plant, there exists execution risk associated with achieving expected production efficiencies, which could impact net margins if delays or inefficiencies occur.

- While there is a focus on acquisitions, the successful integration of new businesses without disrupting current operations is necessary to maintain earnings growth, and there is always acquisition-related risk that could affect financial performance.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $125.889 for AZZ based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $141.0, and the most bearish reporting a price target of just $105.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.8 billion, earnings will come to $195.5 million, and it would be trading on a PE ratio of 24.7x, assuming you use a discount rate of 8.5%.

- Given the current share price of $113.63, the analyst price target of $125.89 is 9.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on AZZ?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.