Last Update 07 Dec 25

TTD: Future Share Strength Will Build On AI And Buyback Execution

Analysts have nudged their average price target for Trade Desk modestly lower to about $82, reflecting a blend of cautious resets around competitive and regulatory headwinds, continued confidence in improving ad demand, Kokai driven execution, and the potential for revenue reacceleration into 2026.

Analyst Commentary

Street research around Trade Desk has become more polarized, with most firms trimming price targets but maintaining constructive views on execution and the multi year growth algorithm, while a smaller group is signaling greater caution on near term growth and competitive pressures.

Bullish Takeaways

- Bullish analysts view the recent beat and raise quarter as evidence that underlying ad demand is improving and that Trade Desk can sustain core growth rates near the 20 percent range exiting the year.

- Several reports highlight Kokai and newer products like Audience Unlimited as key differentiators that are already driving better advertiser outcomes and should support revenue reacceleration into 2026.

- Some bullish analysts argue that current estimates are extremely de risked and the stock remains depressed relative to its long term opportunity, creating an attractive risk or reward skew if growth re accelerates.

- Despite modest target cuts, constructive views emphasize that competitive fears and slowing growth concerns are overblown, with limited perceived downside to the shares from current levels.

Bearish Takeaways

- Bearish analysts point to mounting near term headwinds, including regulatory risk around sensitive verticals such as direct to consumer healthcare, which could weigh on campaign budgets and visibility.

- Intensifying competition from large platforms, including retail media players, is seen by some as making the operating environment more challenging and potentially delaying a clean reacceleration in revenue.

- Concerns around topline deceleration into 2025, combined with recent management changes and product pricing adjustments following customer feedback, have led some to frame the stock as a show me story.

- The recent downgrade to an underperform stance underscores skepticism that current execution will be sufficient to quickly restore prior growth multiples, keeping valuation under pressure until catalysts become more tangible.

What's in the News

- Intuit's SMB MediaLabs audiences are now available on The Trade Desk, giving advertisers privacy conscious access to millions of verified small and mid market business decision makers and expanding reach across CTV, audio, display, and digital out of home.

- The Trade Desk issued fourth quarter 2025 guidance calling for at least $840 million in revenue, indicating management's view of current demand trends and the company's ability to sustain double digit growth.

- The company expanded its equity buyback authorization by $500 million to a total of $2.411 billion and has already repurchased roughly 5.9 percent of shares under the current program. This reinforces management's stated focus on returning capital to shareholders.

- New product initiatives, including the planned launch of Audience Unlimited and Koa Adaptive Trading Modes, are intended to lower the cost and complexity of third party data, while using agentic AI to optimize bidding and campaign performance at scale.

- OpenAI is hiring to build an in house paid marketing platform for ChatGPT. This move could ultimately create a new walled garden ad channel and increase the competitive pressures facing independent demand side platforms such as The Trade Desk (ADWEEK).

Valuation Changes

- Fair Value Estimate remains unchanged at approximately $62.33 per share, indicating no material reassessment of long term intrinsic value.

- The discount rate is effectively unchanged at about 6.96 percent, reflecting a stable risk profile in the valuation model.

- Revenue growth is essentially flat at around 15.84 percent, signaling no meaningful shift in long term top line growth assumptions.

- The net profit margin is stable at roughly 18.78 percent, with no notable revision to long run profitability expectations.

- The future P/E remains unchanged at about 41.9 times, suggesting the valuation multiple outlook remains consistent with prior assumptions.

Key Takeaways

- Trade Desk benefits from the shift toward connected TV and data-driven, measurable advertising, leveraging strong partner relationships and advanced AI platforms for higher growth and margins.

- Global and channel expansion, along with a focus on transparency and independence, position Trade Desk to gain market share as industry trends favor open, objective platforms.

- Heavy reliance on large clients, competition from walled gardens, dependence on CTV, high innovation costs, and limited geographic diversification create significant growth and earnings risks.

Catalysts

About Trade Desk- Operates as a technology company in the United States and internationally.

- The continued rapid shift of ad spend from linear TV to connected TV (CTV) is driving significantly faster growth for Trade Desk's highest-margin channel; deepened relationships with leading CTV and streaming content partners (Disney, Netflix, Roku, LG, etc.) position Trade Desk to capture an outsized share of the expanding premium digital video ad market, which should accelerate revenue and earnings growth as CTV penetration increases globally.

- There is rising demand among brands and agencies for data-driven, measurable advertising with transparent ROI, and Trade Desk's platform (especially with advanced AI/ML features in Kokai and partnerships in retail media and measurement) is uniquely positioned to take share as advertisers prioritize analytics, measurable outcomes, and performance over brand-based, IO-driven spend; this should structurally support revenue growth and improve gross margin as advertisers migrate spend for higher ROI.

- The full rollout and high adoption of the new AI-powered Kokai platform, including new tools like Deal Desk and supply chain innovation (OpenPath, Sincera integration), is already leading to >20% better campaign performance and causing existing clients to increase spend at a much faster rate; as the remaining clients transition and the product matures, this should drive step function increases in platform efficiency, gross margin, and average revenue per client.

- Trade Desk is still early in its global expansion and its push into nontraditional channels (retail media, digital out-of-home, digital audio), with international growth outpacing North America and new partnerships accelerating; this geographic and channel diversification expands TAM and reduces concentration risk, providing strong multi-year support for top-line revenue growth.

- The growing regulatory, advertiser, and consumer push for transparency, privacy, and independence-combined with the pullback of Google and Facebook from open Internet programmatic and increased scrutiny of walled gardens-favor independent, objective platforms like Trade Desk. This competitive positioning is driving a structural shift of ad budgets to Trade Desk, which should translate into durable revenue and margin expansion over the long term.

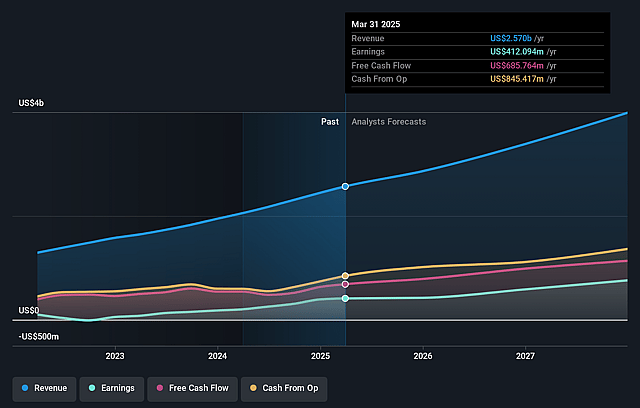

Trade Desk Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Trade Desk's revenue will grow by 17.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 15.6% today to 19.2% in 3 years time.

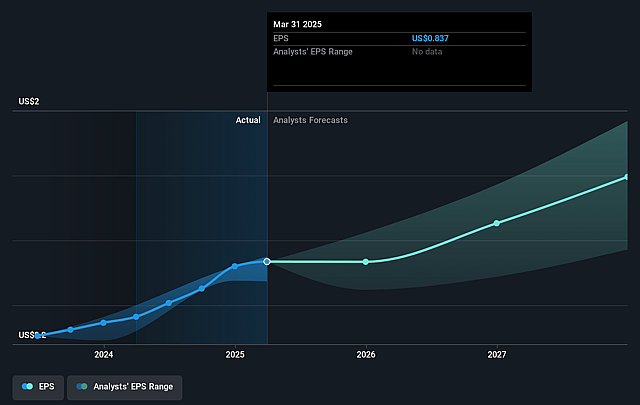

- Analysts expect earnings to reach $823.2 million (and earnings per share of $1.72) by about September 2028, up from $417.2 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $946.0 million in earnings, and the most bearish expecting $360.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 53.0x on those 2028 earnings, down from 61.4x today. This future PE is greater than the current PE for the US Media industry at 20.3x.

- Analysts expect the number of shares outstanding to decline by 0.94% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

Trade Desk Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's exceptionally high reliance on large, global brands and enterprises exposes it to concentrated revenue risk; ongoing macro headwinds such as tariffs, inflation, and volatility in the auto and CPG sectors could lead to cuts in ad spend from these clients, materially impacting near-term and potentially long-term revenue growth and earnings stability.

- Despite a bullish narrative around the open Internet, Trade Desk is facing a persistent risk that walled gardens (e.g., Meta, Amazon, Google) continue to take digital ad market share at a faster pace due to their control of inventory, integrated data, and simplified measurement, limiting Trade Desk's share gains and dampening overall revenue growth prospects.

- While CTV is highlighted as the fastest-growing segment, Trade Desk's substantial dependence on CTV as a growth driver creates exposure to any future saturation, competitive disruption, or cyclical swings in streaming ad inventory, which could lead to earnings volatility and slow overall top-line growth.

- Although management emphasizes innovation in AI and supply chain transparency (e.g., Kokai, OpenPath, Deal Desk), the escalating industry-wide costs to develop and maintain cutting-edge AI-driven solutions may compress operational margins if revenue growth and pricing power do not keep pace.

- Trade Desk's current customer mix is heavily skewed toward North America (~86% of spend), indicating long-term geographic concentration and limited international scale; failure to accelerate global expansion could constrain addressable market growth and leave revenues vulnerable to North American economic cycles.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $75.394 for Trade Desk based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $135.0, and the most bearish reporting a price target of just $34.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.3 billion, earnings will come to $823.2 million, and it would be trading on a PE ratio of 53.0x, assuming you use a discount rate of 6.8%.

- Given the current share price of $52.4, the analyst price target of $75.39 is 30.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Trade Desk?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.