Last Update17 Oct 25Fair value Increased 0.61%

Zurn Elkay Water Solutions' analyst price target has been revised upward by $0.29 to $47.43. Analysts cite robust demand trends, solid growth prospects, and confidence in sustained performance as reasons driving the positive adjustment.

Analyst Commentary

Recent analyst reviews have provided insight into both the opportunities and challenges ahead for Zurn Elkay Water Solutions, with price target increases reflecting confidence in the company's future performance. The feedback from recent investor meetings has been summarized under key themes.

Bullish Takeaways

- Strong demand trends are fueling confidence in Zurn Elkay's ability to achieve near-term estimates and maintain core business momentum into 2026.

- Significant growth of the Elkay drinking water platform continues to be a key driver and is supporting robust earnings and cash flow expansion.

- Analysts are optimistic about the company's operating leverage, which is expected to drive further margin expansion and enhance profitability.

- With substantial cash reserves, Zurn Elkay is viewed as well positioned to pursue its M&A strategy and potentially amplify both scale and shareholder value.

Bearish Takeaways

- While analysts are largely optimistic, some note that the company's valuation appears relatively high compared to peers, which could temper upside potential.

- The sustainability of double-digit earnings and cash flow growth may be challenged if demand trends slow or if execution risks emerge.

- Greater project visibility across end markets is desirable because areas of uncertainty remain around the pace and consistency of customer orders.

What's in the News

- Repurchased 972,619 shares between April 1 and June 30, 2025, completing a total buyback of 21.2 million shares. This represents 14.27% of shares outstanding since 2015 (Key Developments).

- Raised 2025 full-year outlook, with core sales growth expected to be at least 5% year over year (Key Developments).

- Provided third-quarter 2025 guidance, projecting core sales growth to match the growth rate from the second quarter (Key Developments).

Valuation Changes

- Fair Value: Increased slightly from $47.14 to $47.43, reflecting a modest upward adjustment in analyst expectations.

- Discount Rate: Marginally decreased from 8.23% to 8.23%, indicating nearly unchanged risk assessment.

- Revenue Growth: Edged up from 5.14% to 5.14%, signaling a minor increase in projected topline expansion.

- Net Profit Margin: Decreased very slightly from 14.23% to 14.23%, showing minimal change in profitability outlook.

- Future P/E: Increased modestly from 36.05x to 36.27x, suggesting a slightly higher valuation relative to future earnings.

Key Takeaways

- Legislative demand for water quality and filtration advances is expanding market opportunities and ensuring long-term revenue growth through innovative, higher-margin products.

- Supply chain improvements and successful pricing strategies are strengthening cost stability, margin resiliency, and reducing exposure to external market risks.

- Heavy reliance on favorable market timing, policy tailwinds, and price increases leaves growth and margins vulnerable to demand normalization, regulatory delays, cost inflation, or increased competition.

Catalysts

About Zurn Elkay Water Solutions- Engages in design, procurement, manufacture, and marketing of water management solutions in the United States, Canada, and internationally.

- Government funding and rising legislative requirements for water quality in schools (such as filter first mandates) are expected to drive broader adoption of advanced filtration and water safety products, expanding Zurn Elkay's addressable market and boosting long-term revenue growth.

- The rollout and market adoption of the new Elkay Pro Filtration platform-with drop-in replacements, longer filter life, proprietary filters, and IoT/connectivity-positions the company to accelerate replacement cycles and sustain double-digit growth in high-margin filtration revenue, supporting higher earnings and margin expansion.

- Continued share gains and unit volume growth, driven by recent product innovation in drinking water, flow systems, and water control, are beginning to hit the market now and are seen as sustainable, which should strengthen both top-line growth and operational leverage in coming years.

- Ongoing supply chain localization and reduced exposure to tariff volatility are enhancing cost stability, which, combined with successful price realization, underpins confidence in staying price/cost positive and promoting net margin resiliency over the mid to long term.

- Growth in nonresidential construction, especially in healthcare and education-key Zurn Elkay end markets with no current signs of slowdown-supports a robust multi-year demand pipeline, providing stable revenue visibility and mitigating cyclical risk.

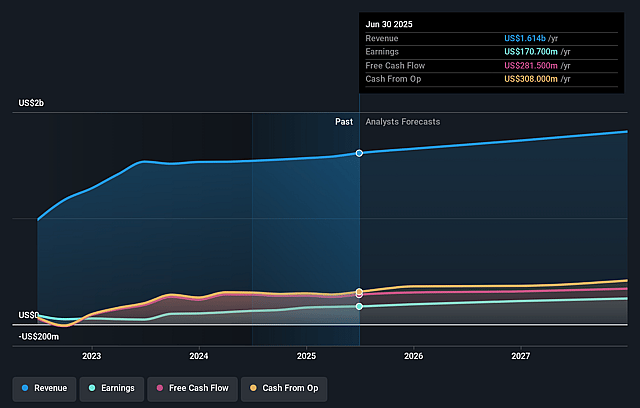

Zurn Elkay Water Solutions Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Zurn Elkay Water Solutions's revenue will grow by 5.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 10.6% today to 14.2% in 3 years time.

- Analysts expect earnings to reach $266.9 million (and earnings per share of $1.43) by about September 2028, up from $170.7 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 34.8x on those 2028 earnings, down from 45.1x today. This future PE is greater than the current PE for the US Building industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 1.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.21%, as per the Simply Wall St company report.

Zurn Elkay Water Solutions Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's recent core growth and margin performance were boosted in part by $8–10 million of customers ordering ahead of announced price increases, which may temporarily inflate sales and mask true end-market demand, potentially leading to slower, less predictable revenue growth and margin normalization in future periods.

- While Zurn Elkay has executed well on tariff management and supply chain relocation, ongoing exposure to trade policy volatility-including Section 232 steel tariffs and new copper tariffs-along with continued raw material price fluctuations, pose sustained risk of margin pressure if price increases cannot keep pace or if material costs remain elevated, ultimately affecting net margins and earnings.

- The company remains heavily reliant on non-residential construction, particularly the healthcare and education sectors. Any delayed impact from budgetary pressures or future federal/state funding cuts in these sectors could reduce project activity, leading to revenue shortfalls and weaker earnings growth.

- Zurn Elkay's growth outlook is closely tied to regulatory developments and state legislation mandating filtered water solutions in schools; if legislative momentum stalls, compliance deadlines are extended, or funding does not materialize as expected, the addressable market may expand more slowly than anticipated, directly impacting revenue growth targets.

- Despite success in launching new products and raising average selling prices, intensified industry competition and the potential for disruptive water technologies (such as decentralized, highly efficient systems) could erode market share and exert pricing pressure, thereby constraining both future revenue growth and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $45.571 for Zurn Elkay Water Solutions based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $50.0, and the most bearish reporting a price target of just $41.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.9 billion, earnings will come to $266.9 million, and it would be trading on a PE ratio of 34.8x, assuming you use a discount rate of 8.2%.

- Given the current share price of $45.9, the analyst price target of $45.57 is 0.7% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.