Last Update 19 Dec 25

Fair value Increased 0.30%APH: AI Connectivity Demand Will Support Margins And Sustained Earnings Outperformance

The Analyst Price Target for Amphenol has inched higher to approximately $149 per share from about $148 per share, as analysts point to sustained earnings beats, improving margin outlooks and rising end market demand across autos, hyperscale data centers and broader connectivity applications.

Analyst Commentary

Bullish analysts have broadly raised their price targets on Amphenol following a string of earnings beats and constructive guidance, highlighting both cyclical recovery and structural growth drivers across key end markets.

Recent research updates point to a combination of strong execution, rising estimates and supportive industry data that together underpin the higher valuation framework now being applied to the shares.

Bullish Takeaways

- Bullish analysts are lifting price targets as Q3 results and Q4 guidance came in ahead of expectations, reinforcing confidence in management's ability to consistently outperform Street revenue and EPS forecasts.

- Upward revisions to FY25 revenue and EPS estimates, including moves toward the mid 20 billion dollar range for sales and low 3 dollar EPS, support a higher long term earnings power narrative and justify richer multiples.

- Improving margin outlooks, driven by a mix of accelerated sales growth, favorable end market exposure and scale from recent acquisitions, are seen as important for sustaining double digit earnings growth.

- Positive book to bill trends and stronger medium term demand expectations in autos, connectivity and broader electronics end markets are viewed as tailwinds that could extend Amphenol's current growth cycle into 2026.

Bearish Takeaways

- Bearish analysts maintaining more neutral ratings argue that much of the near term upside from recent beats and guidance raises is increasingly reflected in the stock's valuation.

- Some caution that the pace of end market recovery, particularly in more cyclical segments, could undershoot elevated expectations, creating downside risk to the newly raised estimates.

- There are concerns that integration and execution around large acquisitions, including the sizable CCS division, must remain flawless to avoid margin pressure and dilution to returns.

- Given Amphenol's strong year to date share performance, skeptics see limited multiple expansion potential from here, with future gains more dependent on sustained delivery against the upgraded growth and margin trajectory.

What's in the News

- Truist raised its price target on Amphenol to $147 from $126 and reiterated a Buy rating, citing Q3 earnings upside and margin expansion potential from faster sales growth and favorable end market mix (Periodicals).

- Amphenol completed a major tranche of its share repurchase program, buying back about 13.4 million shares for roughly $1.0 billion under the buyback announced on April 24, 2024 (Key Developments).

- The Board approved a 52% increase in the quarterly dividend to $0.25 per share, payable January 7, 2026 to shareholders of record on December 16, 2025 (Key Developments).

- The company issued strong Q4 2025 and full year 2025 guidance, projecting sales growth of roughly 39% to 41% for Q4 and 49% to 50% for the full year, with GAAP diluted EPS expected between $0.89 and $0.91 for Q4 and $3.31 to $3.33 for the year (Key Developments).

Valuation Changes

- Fair Value has risen slightly, moving from approximately $148.15 to about $148.60 per share, reflecting a modest increase in the intrinsic value estimate.

- Discount Rate has edged down marginally, from roughly 8.52% to 8.52%, signaling a very small decrease in the assumed cost of capital.

- Revenue Growth expectations are essentially unchanged, ticking down fractionally from about 15.47% to 15.47%, indicating stable top line growth assumptions.

- Net Profit Margin has improved very slightly, increasing from roughly 20.57% to 20.57%, pointing to a minimal uplift in long term profitability expectations.

- Future P/E has risen slightly, from about 35.99x to 36.10x, suggesting a modest expansion in the forward valuation multiple applied to earnings.

Key Takeaways

- Robust demand for high-speed interconnect solutions and diversified end markets strengthens revenue durability and reduces risk from economic cycles.

- Strategic acquisitions, innovation, and a premium product mix are enhancing margins, pricing power, and positioning versus competitors for secular growth.

- Heavy reliance on volatile tech markets, high capex, acquisition risks, and competitive pricing pressures threaten sustainable growth, margin stability, and free cash flow.

Catalysts

About Amphenol- Designs, manufactures, and markets electrical, electronic, and fiber optic connectors in the United States, China, and internationally.

- Accelerating global deployment of AI-driven data centers and adoption of next-generation IT architecture is driving strong, sustained demand for Amphenol's high-speed, high-value interconnect solutions, as evidenced by exceptional growth in IT datacom revenue and continued multi-quarter customer engagement; this is expected to support further top-line growth and maintain higher incremental margins.

- Increased electronic content and complexity across automotive, industrial, defense, and communications markets (including EVs, factory automation, and defense modernization) is expanding Amphenol's total addressable market, enabling diversified, resilient revenue streams and reducing cyclicality risk, which should underpin durability in both sales and earnings.

- Ongoing strategic acquisitions (e.g., ANDREW, CIT, Narda-MITEQ) are broadening product offerings in attractive, high-growth segments (AI, RF/microwave, aerospace/defense), creating further operating leverage and margin expansion opportunities through integration, as reflected in recent record operating margins and sequential improvement in profitability.

- Enhanced focus on high-technology, differentiated product mix-driven by customer demand for mission-critical, high-performance components-has strengthened pricing power and operating efficiency, resulting in structurally higher conversion and operating margins, with management now targeting 30% incremental margin conversion versus the historical 25%.

- Sustained investment in capacity and innovation (elevated CapEx to support datacom/AI growth, R&D for advanced connectors), paired with global supply chain agility and geographic diversification, positions Amphenol to out-execute competitors in capturing future secular growth, supporting robust free cash flow and long-term earnings per share growth.

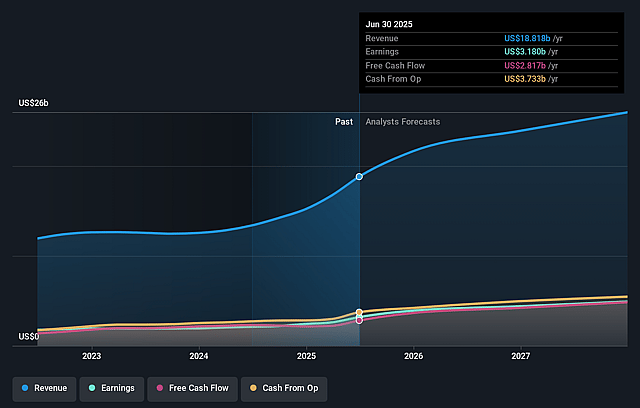

Amphenol Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Amphenol's revenue will grow by 12.7% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.9% today to 18.8% in 3 years time.

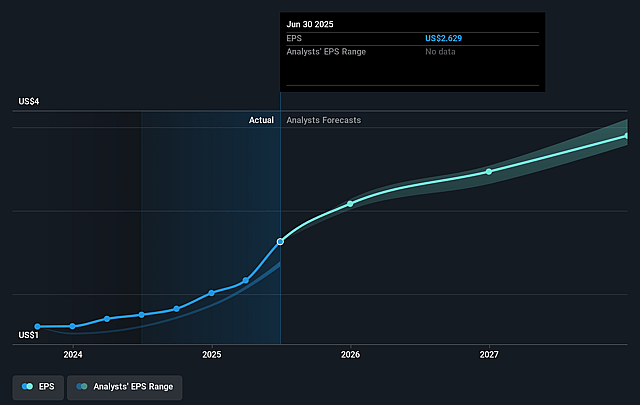

- Analysts expect earnings to reach $5.1 billion (and earnings per share of $4.04) by about September 2028, up from $3.2 billion today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 37.0x on those 2028 earnings, down from 44.8x today. This future PE is greater than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 1.27% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.3%, as per the Simply Wall St company report.

Amphenol Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's unprecedented growth and robust results in the IT datacom and AI infrastructure markets may not be sustainable as sector demand can be volatile and "lumpy"-management specifically acknowledged recent outperformance involved "pulling forward" demand from future quarters, which could lead to short-term revenue declines or stagnation if customer investment moderates.

- Ongoing elevated capital expenditures, especially in support of the booming AI and datacenter demand, could pressure future free cash flow and operating margins if the anticipated growth doesn't persist or if project returns underperform expectations.

- The aggregate contribution to revenue growth from acquisitions is significant, and the text notes "the dilutive impact of acquisitions," as well as the risk that future deals may be less synergistic or harder to integrate, potentially reducing overall net margin improvement.

- Although management highlighted a diversified customer and market base, the results reveal growing exposure to cyclical and fast-evolving technology end markets (notably AI/data center infrastructure), which increases risk of customer concentration and unpredictable revenue/earnings swings as technology cycles or customer budgets shift.

- Intense focus on expanding sales in high-performance, high-margin segments creates challenges to sustain pricing power amid long-term industry trends toward commoditization and system integration, meaning downward pricing pressure or shifts in product mix could erode long-term revenue growth and net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $116.188 for Amphenol based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $134.0, and the most bearish reporting a price target of just $85.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $26.9 billion, earnings will come to $5.1 billion, and it would be trading on a PE ratio of 37.0x, assuming you use a discount rate of 8.3%.

- Given the current share price of $116.79, the analyst price target of $116.19 is 0.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Amphenol?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.