Last Update03 Oct 25Fair value Increased 9.54%

The analyst consensus price target for Roivant Sciences has increased from $18.30 to $20.05. Analysts cite strong Phase 3 dermatomyositis data and anticipated commercial potential as key drivers for the upward revision.

Analyst Commentary

Bullish analysts are increasingly optimistic about Roivant Sciences following the release of strong Phase 3 dermatomyositis data. The latest research updates reflect positive momentum in both valuation outlook and commercial execution prospects.

Bullish Takeaways- Price targets have been broadly raised, with several analysts highlighting significant upside potential driven by robust brepocitinib efficacy in Phase 3 trials for dermatomyositis.

- Market sentiment has improved as investors show confidence in the commercial trajectory of brepocitinib ahead of a planned 2027 launch.

- Analysts view recent milestones, including consistent statistical significance across key clinical endpoints, as strong validation of Roivant's growth strategy.

- Ongoing progress in resolving lipid nanoparticle litigation is viewed as reducing near-term overhang and further supporting upward revisions to fair value estimates.

- Some analysts express caution regarding ongoing legal uncertainties, particularly in high-profile cases such as the Moderna litigation, where key decisions and trials extend into 2026.

- Despite positive clinical results, concerns linger about execution risk as the company prepares for the commercial launch and broader scale-up of its pipeline assets.

- A few analysts maintain a neutral outlook, awaiting further clarity on legal outcomes and subsequent effects on the company’s long-term growth trajectory.

What's in the News

- Positive Phase 3 results from the VALOR study showed brepocitinib 30 mg achieved a significantly higher mean Total Improvement Score at week 52 in dermatomyositis patients compared to placebo. These results support a planned NDA filing in the first half of 2026 (Key Developments).

- Roivant Sciences has announced a share repurchase program and has authorized buybacks of up to $500 million worth of common shares (Key Developments).

- Between April 1, 2025 and June 30, 2025, Roivant completed the repurchase of nearly 20 million shares for $205.15 million. This contributes to a total repurchase of 148.6 million shares for $1.5 billion under the ongoing buyback program (Key Developments).

Valuation Changes

- Consensus Analyst Price Target has increased from $18.30 to $20.05, reflecting a roughly 9.6% upward revision in fair value estimates.

- Discount Rate remains unchanged at 7.16%, indicating analyst risk assessments are stable despite recent developments.

- Revenue Growth projections have risen modestly from 255.47% to 266.37% as updated forecasts factor in strengthened commercial prospects.

- Net Profit Margin is now estimated at 16.11%, up from 14.17%, signaling improved profitability expectations.

- Future P/E ratio has fallen from 85.75x to 75.46x, which suggests analysts expect stronger forward earnings relative to price.

Key Takeaways

- Successful clinical trials and strategic deals may improve revenue and net margins by focusing on high-value areas.

- Potential in-licensing and late-stage pipeline approvals could significantly enhance earnings and portfolio sales impact.

- Execution risks and competitive pressures could delay Roivant's earnings growth and profitability amidst high R&D costs and legal uncertainties.

Catalysts

About Roivant Sciences- A commercial-stage biopharmaceutical company, engages in the development and commercialization of medicines for inflammation and immunology areas.

- Roivant Sciences is focused on clinical trial execution with multiple ongoing trials, including late-stage programs like brepocitinib and batoclimab, which are expected to generate significant data readouts in the near future. Successful trial outcomes may positively impact future revenue streams.

- The company has completed the Dermavant deal, potentially allowing a greater focus on clinical execution and the upside of VTAMA. This could improve net margins by refocusing capital and operational efforts on higher-value areas.

- Roivant's late-stage pipeline, with potential approvals expected in the next couple of years, could lead to a projected $10 billion+ peak sales portfolio, significantly impacting earnings as these therapies are commercialized.

- Business development activities with negotiations for potential in-licensing of new programs are ongoing, representing opportunities for revenue growth through the expansion of their development-stage clinical pipeline.

- Roivant's commitment to returning capital to shareholders, including significant stock repurchases, is a catalyst for EPS growth, reflecting a potential undervaluation of current share prices if business fundamentals improve.

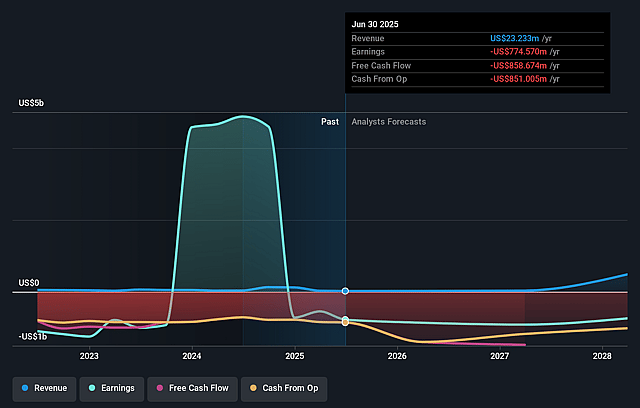

Roivant Sciences Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Roivant Sciences's revenue will grow by 59.2% annually over the next 3 years.

- Analysts are not forecasting that Roivant Sciences will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate Roivant Sciences's profit margin will increase from 3558.5% to the average US Biotechs industry of 16.1% in 3 years.

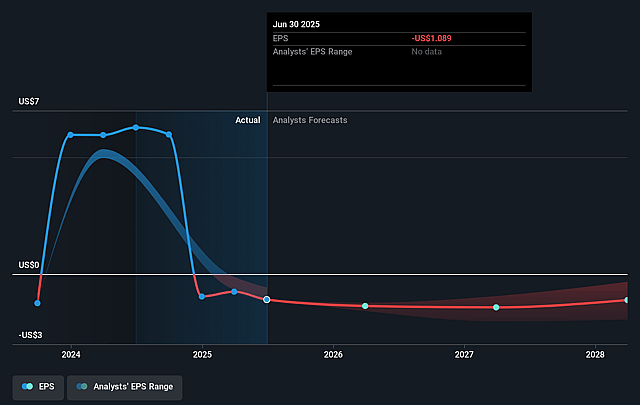

- If Roivant Sciences's profit margin were to converge on the industry average, you could exepct earnigns to reach $83.8 million (and earnings per share of $0.16) by about January 2028, down from $4.6 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 126.9x on those 2028 earnings, up from 1.8x today. This future PE is greater than the current PE for the US Biotechs industry at 17.5x.

- Analysts expect the number of shares outstanding to decline by 9.45% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.85%, as per the Simply Wall St company report.

Roivant Sciences Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Roivant Sciences faces execution risks in clinical trial management across multiple ongoing trials, which could negatively affect their revenue and delay potential earnings growth.

- The competitive landscape, especially from well-established treatments like Humira, may limit Roivant's ability to capture market share quickly, impacting their expected revenue and potential profitability.

- There are legal uncertainties with ongoing LNP litigation, which could result in financial liabilities or distract management, thereby affecting net margins.

- Given the early development stage of many of Roivant’s drugs, there is a risk of clinical trial failures or delays, potentially impacting potential future revenues and profitability.

- The projected high R&D expenses and ongoing share repurchase program could strain Roivant’s financial resources, potentially impacting their cash flow and net income.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $16.14 for Roivant Sciences based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $18.0, and the most bearish reporting a price target of just $13.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $520.7 million, earnings will come to $83.8 million, and it would be trading on a PE ratio of 126.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $11.15, the analyst's price target of $16.14 is 30.9% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.