Last Update 22 Jan 26

VPG: Index Inclusion And Revenue Guidance Will Sustain An Overstretched Outlook

Analysts kept their price target for Vishay Precision Group broadly unchanged at about $42. This reflected only minimal tweaks to assumptions such as discount rate, long term revenue growth, profit margin, and future P/E that did not materially alter their overall view of the shares.

What's in the News

- Vishay Precision Group, Inc. (NYSE: VPG) was added to the S&P Technology Hardware Select Industry Index, which can influence how index funds and ETFs gain exposure to the shares (Key Developments).

- The company issued revenue guidance for the fourth fiscal quarter of 2025, expecting net revenues in the range of $75 million to $81 million at constant third fiscal quarter 2025 foreign currency exchange rates (Key Developments).

Valuation Changes

- Fair Value Estimate: held broadly steady at about $42.0 per share, indicating no material change in the overall valuation anchor used in the model.

- Discount Rate: adjusted marginally from 8.614334% to 8.613707%, a very small technical refinement to the cost of capital input.

- Revenue Growth: kept essentially unchanged at 5.993487%, suggesting no update to the long term growth outlook used in the model.

- Net Profit Margin: maintained at roughly 7.744385%, with only a very small numerical refinement that does not alter the earnings profile assumption.

- Future P/E: kept almost flat, moving slightly from 25.348224x to 25.347784x, indicating a stable view of the valuation multiple applied to future earnings.

Key Takeaways

- Rising demand in automation, robotics, and new technology sectors positions the company for revenue growth and improved margins as these markets expand.

- Operational efficiencies, cost reductions, and pricing power are set to enhance profitability and support stable long-term earnings even during uncertainty.

- Dependence on customer production decisions, geopolitical risks, subdued key markets, margin compression, and restructuring challenges could drive earnings volatility and threaten long-term profitability.

Catalysts

About Vishay Precision Group- Engages in the precision measurement and sensing technologies business in the United States, Europe, Israel, Asia, and Canada.

- The strong sequential growth in bookings and a positive book-to-bill ratio across key segments indicate building demand for VPG's precision sensors and measurement products, positioning the company to benefit as global Industry 4.0 adoption and automation trends accelerate-likely supporting top-line revenue growth.

- New order momentum in cutting-edge markets such as humanoid robotics and beta installations for high-performance testing systems (e.g., UHTC for aerospace and energy) show VPG's entry into high-growth, high-margin niches, which can meaningfully expand gross margin and improve earnings quality as these end-markets scale.

- The company's focus on operational efficiencies-including a $5 million fixed cost reduction program and consolidation of production into lower-cost countries-is set to enhance margin leverage as volumes recover, which should lead to higher EBITDA and net margin upside as revenues rebound.

- Bookings related to electrification and precision agriculture, along with recent data center orders, validate VPG's exposure to secular shifts toward electrified vehicles, renewables, and infrastructure modernization-creating multi-year revenue tailwinds as these sectors continue expanding.

- Demonstrated pricing power, observed through strategic tariff-driven price adjustments and proprietary solutions, supports VPG's ability to maintain or raise margins even amid macroeconomic and geopolitical uncertainty, underpinning long-term earnings predictability.

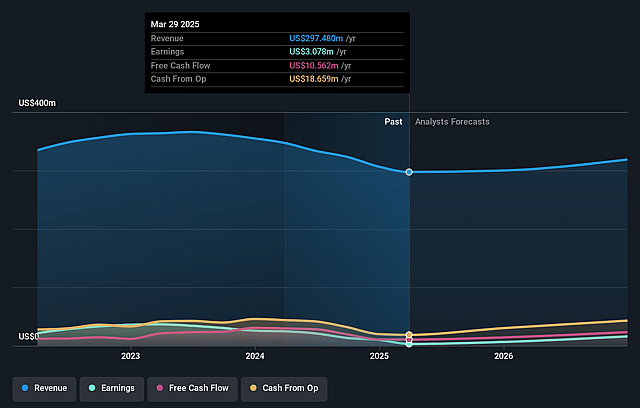

Vishay Precision Group Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Vishay Precision Group's revenue will grow by 5.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from -0.4% today to 19.7% in 3 years time.

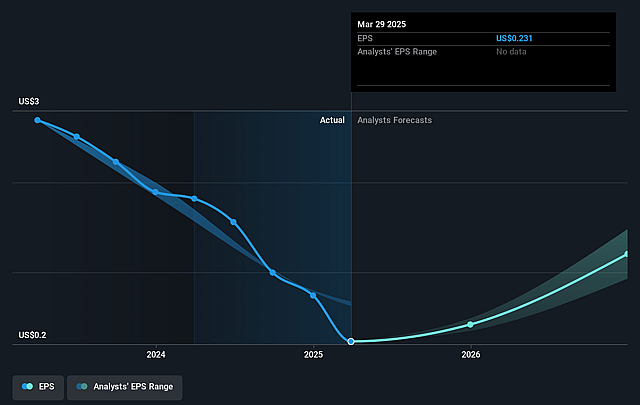

- Analysts expect earnings to reach $67.2 million (and earnings per share of $5.05) by about September 2028, up from $-1.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 8.3x on those 2028 earnings, up from -309.2x today. This future PE is lower than the current PE for the US Electronic industry at 23.9x.

- Analysts expect the number of shares outstanding to grow by 0.31% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.53%, as per the Simply Wall St company report.

Vishay Precision Group Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's growth in the humanoid robotics market is highly dependent on the schedules and production ramp-up decisions of its customers, introducing significant revenue uncertainty and execution risk-potentially leading to volatile or delayed revenues if customer adoption or industry timelines slip.

- Exposure to tariffs, geopolitical tensions, and changing global trade policies has already negatively impacted gross margins, and further unpredictability in these areas could continue to pressure profitability and increase cost volatility, impacting both gross and net margins.

- The steel market and certain transportation end-markets remain subdued, with order variability and weak macro demand, leading to cyclical risk and vulnerability to downturns in these key sectors-which could constrain future revenue growth and create earnings volatility.

- Anticipated margin improvement from higher volumes in robotics or new applications may be undercut by the requirement for lower pricing in high-volume production scenarios, risking margin compression as new industries scale and threatening long-term profitability.

- While cost-saving programs and overseas production consolidation aim to improve efficiency, such restructuring also comes with risks of operational disruption, increased execution complexity, and potential quality or supply challenges-potentially impacting SG&A expense, capital allocation, and free cash flow if not managed effectively.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $33.5 for Vishay Precision Group based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $341.6 million, earnings will come to $67.2 million, and it would be trading on a PE ratio of 8.3x, assuming you use a discount rate of 8.5%.

- Given the current share price of $29.73, the analyst price target of $33.5 is 11.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Vishay Precision Group?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.