Last Update29 Aug 25Fair value Increased 7.73%

Despite a notable decline in revenue growth forecasts, increased valuation multiples have driven Donaldson Company's consensus analyst price target higher from $72.40 to $78.00.

What's in the News

- Fiscal 2026 earnings guidance issued: EPS expected between $3.92 and $4.08, with sales projected to increase 1% to 5% to $3.8 billion at midpoint, including a 1% pricing benefit.

- Completed share buyback of 6,631,404 shares (5.56% of shares outstanding) for $455.84 million under the buyback program announced November 2023.

- Formed a strategic partnership with Mighty Distributing System, expanding heavy-duty product offerings and inventory management services for fleet and equipment operators.

- Reported $62 million in intangible asset impairment charges for the third quarter ended April 2025.

- Fiscal 2025 sales forecast reaffirmed with 1% to 3% year-over-year growth, driven largely by pricing, with minimal impact from currency and tariffs.

Valuation Changes

Summary of Valuation Changes for Donaldson Company

- The Consensus Analyst Price Target has risen from $72.40 to $78.00.

- The Consensus Revenue Growth forecasts for Donaldson Company has significantly fallen from 4.6% per annum to 4.1% per annum.

- The Future P/E for Donaldson Company has risen slightly from 18.69x to 19.53x.

Key Takeaways

- Expansion into high-growth filtration segments and strategic acquisitions are enhancing profit margins, earnings quality, and product innovation.

- Increased demand from stricter regulations, automation, and urbanization is driving sustained sales growth, recurring revenue, and operating margin improvement.

- Heavy dependence on legacy product segments and aftermarket sales, combined with external market headwinds, threatens long-term revenue growth, margin stability, and earnings predictability.

Catalysts

About Donaldson Company- Manufactures and sells filtration systems and replacement parts worldwide.

- Global expansion of environmental regulations and emissions standards is increasing demand for advanced filtration across industrial and transportation sectors, positioning Donaldson to achieve record sales in both Industrial Solutions and Mobile Solutions, with a direct positive impact on revenue and earnings growth in FY26 and beyond.

- Industrial automation and digitalization are driving higher requirements for contaminant-free environments, fueling double-digit growth in Donaldson's connected and aftermarket filtration solutions, improving the recurring revenue base and operating margins.

- Continued urbanization and infrastructure build-out globally-particularly in China and power generation-are expanding addressable markets, supporting recovery in first-fit sales and sustaining backlog visibility, underpinning revenue stability and top-line growth.

- Strategic investments and M&A in high-margin, structurally growing segments (e.g., Life Sciences and Food & Beverage filtration) are expected to enhance margin mix and earnings quality, with Life Sciences segment margins improving notably and diversified R&D accelerating product innovation.

- Ongoing replacement parts/service model and the rising installed base are improving revenue predictability and resilience, increasing aftermarket sales mix (now over 50% of certain businesses), which supports stable cash flow and long-term earnings durability.

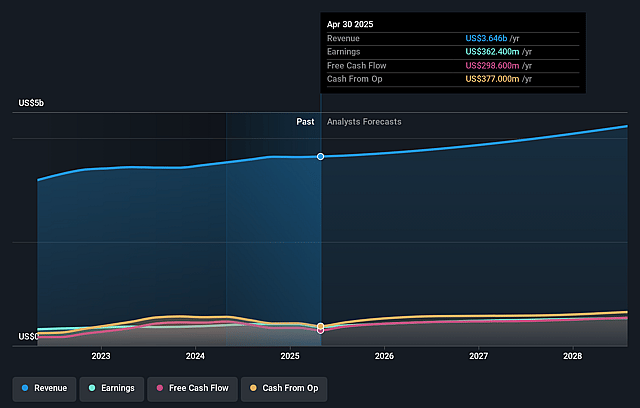

Donaldson Company Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Donaldson Company's revenue will grow by 4.6% annually over the next 3 years.

- Analysts assume that profit margins will increase from 9.9% today to 12.6% in 3 years time.

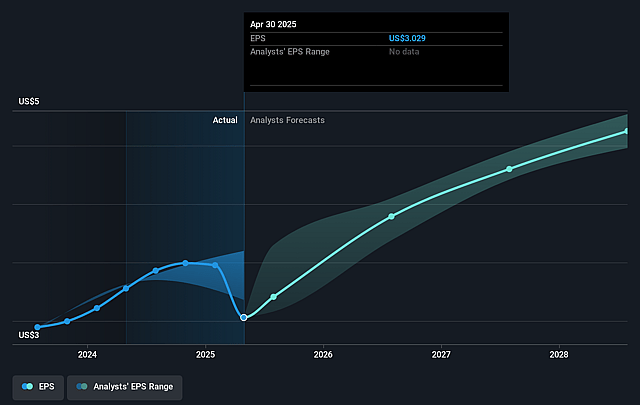

- Analysts expect earnings to reach $523.7 million (and earnings per share of $4.54) by about August 2028, up from $362.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.7x on those 2028 earnings, down from 24.3x today. This future PE is lower than the current PE for the US Machinery industry at 24.3x.

- Analysts expect the number of shares outstanding to decline by 2.68% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.11%, as per the Simply Wall St company report.

Donaldson Company Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent delays and muted performance in bioprocessing, a key growth driver within Life Sciences, suggest a slower-than-expected ramp in high-margin segments, limiting revenue growth and margin expansion until at least fiscal 2027.

- Heavy reliance on aftermarket and replacement part sales in both Mobile and Industrial Solutions exposes the company to long-term risks if customers gradually shift toward maintenance-free systems or adopt circular economy practices, which could weaken recurring revenue streams and future cash flow predictability.

- Ongoing uncertainties and caution regarding demand in China and other APAC and LatAm regions, including operating challenges from international trade tensions or macroeconomic headwinds, may constrain international sales growth and curtail overall top line expansion.

- Donaldson's strategy and current mix are still significantly dependent on traditional engine-based (ICE-related) filtration; despite growing diversification, accelerated electrification in transportation and off-highway equipment could erode core market revenue over the long term as demand for ICE filtration products declines.

- Substantial gross margin sensitivity to tariff-related cost inflation, LIFO accounting volatility, and ongoing footprint optimization initiatives signals exposure to operational margin squeeze if raw material or input costs rise and the company is unable to sustain price increases, posing a risk to net margin and future earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $72.4 for Donaldson Company based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.2 billion, earnings will come to $523.7 million, and it would be trading on a PE ratio of 18.7x, assuming you use a discount rate of 8.1%.

- Given the current share price of $75.63, the analyst price target of $72.4 is 4.5% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.