Last Update 06 Dec 25

RKLB: Rising Launch Cadence Will Drive Future Confidence In Durable Cash Generation

Rocket Lab's analyst price target has moved modestly higher to the mid $60s per share, as analysts highlight sustained Electron launch demand, growing Space Systems revenue, and expectations that industry consolidation and scale economics will favor well positioned incumbents, despite Neutron schedule shifts and slightly higher perceived risk.

Analyst Commentary

Street research remains broadly constructive on Rocket Lab, with most updates reflecting confidence in the company’s ability to translate launch demand and Space Systems momentum into sustained revenue growth and margin expansion, even as Neutron timing is pushed to the right.

Bullish Takeaways

- Bullish analysts are lifting price targets into the $60 to high $60s range. They argue that the current valuation does not fully reflect Rocket Lab’s positioning as a potential long term consolidator in a scale driven space market.

- Several notes highlight a robust Electron launch cadence, including four launches in the latest quarter, as evidence that demand and pricing power support a higher, more durable revenue base.

- Expectations for results near the high end of prior guidance, alongside anticipated sequential adjusted gross margin expansion, reinforce the view that operational execution is tracking ahead of early stage peers.

- Analysts see Space Systems growth, helped by SDA production ramp, as a key driver of diversification and multiple support, lessening dependence on any single vehicle or program.

Bearish Takeaways

- Bearish analysts emphasize that Neutron’s first launch shifting into 2026 extends the investment cycle. This could weigh on near term free cash flow and delay the realization of expected scale benefits.

- There is concern that schedule revisions may create a cascading manifest impact, increasing execution risk and potentially limiting upside to current forecasts if further slippage occurs.

- Some research maintains a more neutral stance on the stock. These analysts suggest that the recent rerating already prices in much of the Electron strength and Space Systems upside, leaving less room for multiple expansion if growth moderates.

What's in the News

- Rocket Lab scheduled its next Electron mission, Follow My Speed, to lift off from New Zealand less than 48 hours after a successful HASTE launch from Virginia, setting up a record 18th annual launch and showcasing rapid, responsive launch operations (Company announcement).

- The company successfully conducted a HASTE suborbital mission for the Defense Innovation Unit and Missile Defense Agency, testing advanced hypersonic and missile defense technologies just 14 months after contract signing (Company announcement).

- Rocket Lab announced a dedicated Electron launch for JAXA's RAISE 4 mission in December 2025, the first of two contracted JAXA flights that underscore Electron's role in providing responsive access to space for international agencies (Company announcement).

- Rocket Lab secured a second multi launch contract with Synspective, bringing the total to 21 future dedicated Electron launches for StriX SAR satellites and marking the largest single customer order in Electron's history (Company announcement).

- The company delivered two ESCAPADE Mars spacecraft to NASA's Kennedy Space Center after completing design, build, integration, and testing in just three and a half years, highlighting Rocket Lab's vertically integrated Space Systems capabilities (Company announcement).

Valuation Changes

- Fair Value Estimate has remained unchanged at approximately $65.67 per share. This indicates no material shift in the long term intrinsic value assessment.

- Discount Rate has risen slightly from about 7.50 percent to roughly 7.56 percent, reflecting a modest increase in perceived risk or required return.

- Revenue Growth has remained effectively flat at around 36.36 percent, suggesting no meaningful change in long term top line growth expectations.

- Net Profit Margin has held steady at approximately 10.28 percent, with no significant revision to long term profitability assumptions.

- Future P/E has increased marginally from about 369.29x to roughly 369.87x, signaling a very small upward adjustment in the implied forward earnings multiple.

Key Takeaways

- Expanded vertical integration and end-to-end space solutions position Rocket Lab for major defense contracts and future margin growth.

- High launch cadence, satellite manufacturing, and reusable rocket development enable multi-year revenue growth, backlog expansion, and broader market access.

- High R&D costs, contract dependence, competition, and regulatory risks threaten profitability, while M&A and integration complexity may distract from core execution and margin improvement.

Catalysts

About Rocket Lab- A space company, provides launch services and space systems solutions in the United States, Canada, Japan, and internationally.

- Rocket Lab's move toward end-to-end space solutions-including the acquisition of Geost and expanding vertically integrated payload, satellite, and launch service capabilities-uniquely positions the company to capture larger, national security and defense contracts like the Golden Dome and SDA constellations, supporting significant top-line growth and enhanced gross margins in future quarters.

- Escalating demand for real-time data, earth observation, and global connectivity is driving increasing recurring revenue opportunities through satellite constellation launches and manufacturing-Rocket Lab's high Electron launch cadence and in-house satellite production (including potential for future proprietary constellations) are enabling the company to capitalize on these industry tailwinds, supporting multi-year revenue growth and backlog expansion.

- Successful development and operational ramp of the medium-lift reusable Neutron rocket will allow Rocket Lab to target larger, higher-value payloads (including those currently reliant on Falcon 9), increasing addressable market, boosting revenue, and driving margin expansion through production scale and vehicle reusability.

- Demonstrated pricing power and international expansion-highlighted by increased Electron average selling prices, strong international agency demand, and multi-launch agreements-reflect Rocket Lab's differentiated reliability and execute status in a consolidating launch market, likely supporting higher net margins and revenue predictability.

- Current elevated investment in R&D, infrastructure, and acquisitions is masking near-term earnings and cash flow, but the company's strong cash position, clear line of sight to significant government/commercial contract wins, and shifting focus from R&D to production post-Neutron debut are poised to deliver operating leverage and profitability as secular industry demand continues to accelerate.

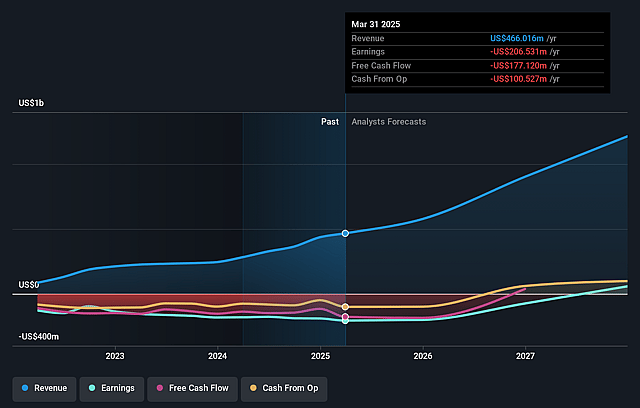

Rocket Lab Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Rocket Lab's revenue will grow by 37.5% annually over the next 3 years.

- Analysts assume that profit margins will increase from -45.9% today to 8.7% in 3 years time.

- Analysts expect earnings to reach $113.4 million (and earnings per share of $0.21) by about September 2028, up from $-231.3 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 216.7x on those 2028 earnings, up from -90.8x today. This future PE is greater than the current PE for the US Aerospace & Defense industry at 34.4x.

- Analysts expect the number of shares outstanding to decline by 4.11% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.61%, as per the Simply Wall St company report.

Rocket Lab Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Sustained elevated R&D and capital expenditures for Neutron development and scaling, with management projecting ongoing negative free cash flow and cash consumption into 2027 or beyond-this could materially pressure earnings and increase dilution risk if capital markets tighten or if expected revenue growth is delayed.

- Management highlighted project "lumpiness" and dependency on large contract wins (e.g., SDA Tranche 3, Golden Dome), exposing Rocket Lab to program delays, revenue recognition volatility, and heightened execution risk that could lead to irregular revenue, backlog fluctuations, and lower-than-expected operating leverage.

- While demand signals for Neutron are strong, actual customer commitment is lagging until a successful test flight, and management noted that increased competition (including established and well-capitalized peers like SpaceX and potential industry consolidation) could lead to margin compression, limited pricing power, and risk to long-term revenue targets if Neutron faces technical or schedule setbacks.

- The strategy of rapid vertical integration and aggressive M&A expands capabilities and addressable market, but also introduces operational complexities, integration risks, and possible distractions from core execution. Acquisition-driven growth requires sustained access to capital and successful integration to avoid impacting net margins and profitability.

- Exposure to variable trends in commercial and government launch budgets, and the risk of regulatory or geopolitical headwinds (such as export controls or launch bottlenecks at federal sites), could reduce launch frequency, delay government contract awards, and limit access to key international markets. These long-term trends could negatively impact revenue growth and market share if not mitigated.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $46.4 for Rocket Lab based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $60.0, and the most bearish reporting a price target of just $20.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.3 billion, earnings will come to $113.4 million, and it would be trading on a PE ratio of 216.7x, assuming you use a discount rate of 7.6%.

- Given the current share price of $43.53, the analyst price target of $46.4 is 6.2% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.