Last Update31 Jul 25Fair value Increased 0.66%

Winnebago Industries’ consensus price target remained steady at $37.83 as analysts cut guidance and earnings estimates due to continued macroeconomic uncertainty, weak demand, and operational headwinds, although some see the recent stock selloff as overdone relative to the company’s strong brand and industry resilience.

Analyst Commentary

- Lowered guidance and earnings estimates for FY25-FY27 due to soft seasonal demand, weak consumer confidence, and continued pressure in Winnebago-branded products, with incremental positives from June retail and market share trends.

- Macroeconomic uncertainty, dealer austerity, and tariff headwinds are weighing on near-term outlook, with most analysts highlighting muted dealer ordering and cautious management commentary.

- Operational issues and headwinds in legacy Winnebago motorized operations persist, prompting major guidance and EPS cuts and concern the weakness could extend into FY26.

- Despite in-line or slightly better-than-expected Q3 results, the magnitude of the stock's decline is viewed by some as excessive given Winnebago’s strong brand portfolio, shipment discipline, and resilience in outdoor recreation trends.

- Bullish analysts remain positive on long-term industry demand and Winnebago’s commitment to inventory management and new product momentum, particularly in towables, though near-term uncertainty tempers enthusiasm.

What's in the News

- Winnebago Industries held a management meeting with KeyBanc in Chicago on July 1, 2025 (Periodicals).

- The company updated its fiscal year 2025 earnings guidance, expecting net revenues between $2.7 billion and $2.8 billion and reported EPS between $0.50 and $1.00 (Key Developments).

- For the third quarter ended May 31, 2025, Winnebago expects net revenues of approximately $775 million and EPS in the range of $0.55 to $0.65 (Key Developments).

- Winnebago launched the all-new Thrive™ lightweight travel trailer, featuring innovative design and comfort-focused amenities, with nationwide dealership arrivals starting late May to early June 2025 (Key Developments).

- In partnership with KORE, Robo, and Ericsson, Winnebago unveiled “Winnebago Connect™,” a connected RV platform with intelligent automation, smart energy management, and real-time vehicle tracking (Key Developments).

Valuation Changes

Summary of Valuation Changes for Winnebago Industries

- The Consensus Analyst Price Target remained effectively unchanged, at $37.83.

- The Net Profit Margin for Winnebago Industries remained effectively unchanged, at 6.44%.

- The Consensus Revenue Growth forecasts for Winnebago Industries remained effectively unchanged, at 7.2% per annum.

Key Takeaways

- Strategic product innovations and lineup expansion across brands aim to enhance market share, revenue growth, and customer relationships in diverse segments.

- Tri-brand strategy in motorhomes and Barletta's channel expansion could mitigate risks and drive profit through market diversification and increased margins.

- Growing macroeconomic uncertainty, inflationary pressures, and increased competition could impact Winnebago's revenues, margins, and market share amidst soft retail conditions and cautious consumer demand.

Catalysts

About Winnebago Industries- Manufactures and sells recreation vehicles and marine products primarily for use in leisure travel and outdoor recreation activities.

- The successful launch and ramp-up of the Grand Design Motorhome Lineage lineup, including new models like the Series M Class C, Series F Super C Coach, and Series VT Class B, is expected to boost future revenues and market share in the motorized RV segment.

- The strategic transformation of Winnebago Towables under new leadership, with a focus on innovative pricing and product strategies, aims to increase market share and drive revenue growth in the competitive towables market.

- The development of new product offerings such as the Newmar Summit Aire and the expansion of Newmar's model year 2026 lineup are expected to strengthen dealer relationships, broaden the customer base, and enhance revenue growth.

- A tri-brand strategy in the motorhome sector (Winnebago, Grand Design, and Newmar) to cater to distinct market segments may mitigate risk and unlock potential for greater margin expansion and revenue diversification.

- Barletta's strategic channel expansion and innovative new model introductions are positioned to leverage its growing U.S. pontoon market share, which should positively impact revenue and profitability.

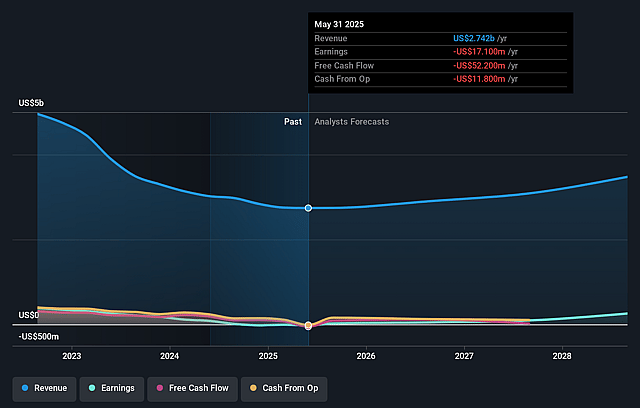

Winnebago Industries Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Winnebago Industries's revenue will grow by 7.2% annually over the next 3 years.

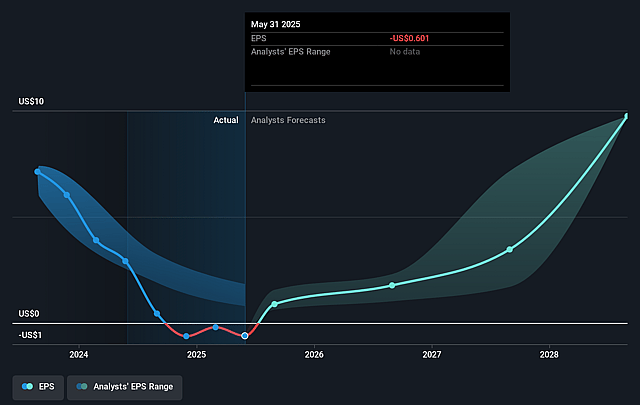

- Analysts assume that profit margins will increase from -0.6% today to 6.4% in 3 years time.

- Analysts expect earnings to reach $217.6 million (and earnings per share of $8.17) by about August 2028, up from $-17.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.2x on those 2028 earnings, up from -58.7x today. This future PE is lower than the current PE for the US Auto industry at 18.5x.

- Analysts expect the number of shares outstanding to decline by 3.07% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 12.32%, as per the Simply Wall St company report.

Winnebago Industries Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Growing macroeconomic uncertainty and soft retail conditions present a challenging sales environment for Winnebago, potentially impacting future revenues and earnings.

- Expected tariffs and inflationary pressures may affect product costs and consumer purchasing power, potentially leading to reduced revenue and compressed net margins.

- Dealers are maintaining leaner inventory levels due to higher carrying costs and cautious consumer demand, which could limit revenue growth if market conditions do not improve.

- A decrease in adjusted EPS guidance reflects lowered consumer confidence and sentiment, suggesting potential impacts on profitability and earnings.

- Increased competition and elevated discounting, particularly in the motorhome segment, could pressure Winnebago’s market share and margins if pricing and inventory strategies are not effectively managed.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $38.083 for Winnebago Industries based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $26.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.4 billion, earnings will come to $217.6 million, and it would be trading on a PE ratio of 6.2x, assuming you use a discount rate of 12.3%.

- Given the current share price of $35.84, the analyst price target of $38.08 is 5.9% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.