Last Update 03 Dec 25

ALLE: Expanded Access Solutions Will Drive Strong Demand And Higher Returns In 2025

Analysts have modestly raised their price target on Allegion to approximately $183.09 per share, citing steady expectations for revenue growth, profit margins, and valuation multiples, even with a slightly higher assumed discount rate.

What's in the News

- Allegion plc raised its 2025 full-year guidance, now expecting 7.0% to 8.0% reported revenue growth and EPS of $7.45 to $7.55 (or $8.10 to $8.20 on an adjusted basis) (Corporate Guidance: Raised).

- The company reported that, as of September 30, 2025, it has completed repurchases of 8,320,675 shares for approximately $1.02 billion under its long-running buyback program announced in February 2020 (Buyback Tranche Update).

- Allegion US launched Schlage Performance Series locks, targeting budget-sensitive commercial real estate and multifamily projects with new PM Series mortise, PC Series cylindrical, and PT Series tubular products designed for faster installs and reliable security (Product-Related Announcements).

- Zentra, an Allegion US brand, became the first to offer resident key capability in Google Wallet, enabling tap-to-unlock access across multifamily communities using Android phones and Wear OS smartwatches and supporting several Schlage smart lock platforms (Product-Related Announcements).

- Allegion Americas and Brivo announced a partnership delivering a Connected Openings solution that uses existing building Wi-Fi to support Schlage XE360 wireless locks, expanding cloud-based, real-time access control options for multifamily and commercial properties while lowering installation costs (Client Announcements).

Valuation Changes

- Fair Value Estimate: unchanged at approximately $183.09 per share, indicating no revision to intrinsic value despite updated assumptions.

- Discount Rate: risen slightly from about 9.31% to 9.35%, reflecting a modest increase in the assumed cost of capital.

- Revenue Growth: effectively unchanged at roughly 7.83% annually, signaling consistent expectations for top line expansion.

- Net Profit Margin: essentially flat at around 17.19%, indicating stable long term profitability assumptions.

- Future P/E Multiple: increased marginally from about 23.71x to 23.73x, suggesting a slightly higher valuation placed on forward earnings.

Key Takeaways

- Expansion in digital security and strategic acquisitions is boosting recurring revenue and enhancing the company's margin profile through innovative product offerings.

- Strong demand in institutional and nonresidential markets, combined with operational discipline, is driving stable growth and reducing earnings volatility.

- Heavy reliance on nonresidential cycles, international weakness, cost pass-through risks, aggressive acquisitions, and slow innovation in the mechanical business all threaten Allegion's long-term growth and competitiveness.

Catalysts

About Allegion- Engages in the provision of security products and solutions worldwide.

- Robust expansion in smart and connected security solutions-particularly through strong electronics growth (double-digit in Q2) and new launches like SimonsVoss's batteryless FORTLOX electronic cylinder-positions Allegion to benefit from increased adoption of IoT and digital building management, supporting higher future revenues and improved margin mix.

- Rising global focus on safety and security, especially in resilient institutional and nonresidential markets (healthcare, education, data centers), is fueling demand for advanced security solutions, providing steady end-market growth that supports sustainable earnings and lowers revenue cyclicality.

- Strategic investments in electronic/software acquisitions (ELATEC, Gatewise, Waitwhile) are expected to drive new recurring revenue streams and margin accretion starting in 2026, enhancing both top-line growth and net margin profile as SaaS and high-margin hardware gain share of the portfolio.

- Execution of targeted M&A and effective integration are broadening Allegion's geographic and product reach, with accretive acquisitions improving adjusted EPS and providing operational leverage that supports long-term earnings growth.

- Resilient nonresidential Americas growth, combined with improved operational performance and disciplined pricing actions to mitigate inflation/tariff impacts, are expanding adjusted operating margins and providing a foundation for ongoing cash flow and earnings stability.

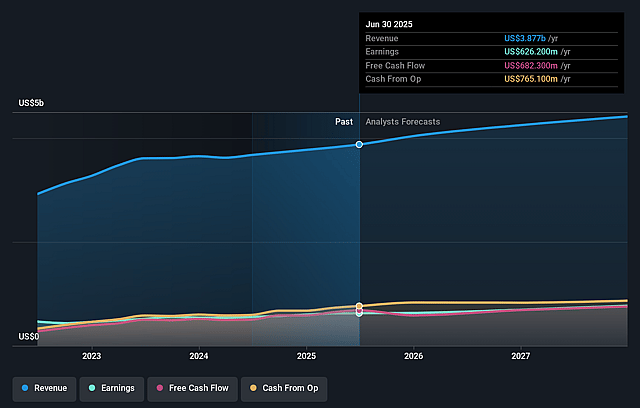

Allegion Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Allegion's revenue will grow by 7.1% annually over the next 3 years.

- Analysts assume that profit margins will increase from 16.2% today to 17.3% in 3 years time.

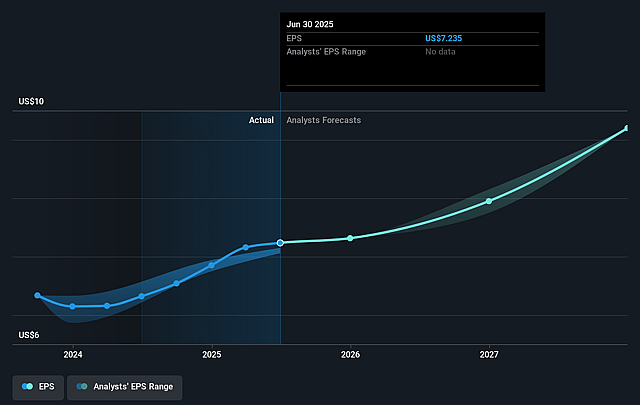

- Analysts expect earnings to reach $825.7 million (and earnings per share of $10.09) by about September 2028, up from $626.2 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 22.2x on those 2028 earnings, down from 23.3x today. This future PE is lower than the current PE for the US Building industry at 23.0x.

- Analysts expect the number of shares outstanding to decline by 1.25% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.04%, as per the Simply Wall St company report.

Allegion Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Persistent weakness in the International segment, with continued organic revenue declines driven by underperformance in the mechanical portfolio, could signal ongoing challenges in markets outside North America, leading to long-term earnings volatility and reduced revenue growth from global expansion.

- Residential markets remain soft in the Americas, attributed to high interest rates, suggesting that Allegion's growth is heavily reliant on the nonresidential cycle; any downturn or deceleration in nonresidential construction would put significant pressure on overall revenue and margin expansion.

- The ongoing need to pass cost inflation through surcharges and price increases, particularly in response to volatile tariffs, risks exposing Allegion to future pricing pressures, potential customer resistance, or regulatory changes, which could erode margins or dampen demand, impacting both near

- and long-term profitability.

- Heavy emphasis on acquisitions and integration to drive growth, while currently successful, leaves Allegion exposed to execution risk, potential cultural or operational mismatches, and the possibility of overpaying, which could result in impaired returns and weaker net margins if synergy capture and operational leverage do not materialize as planned.

- The slow pace of growth or innovation in Allegion's legacy mechanical business, particularly as secular trends accelerate toward advanced, integrated, and cloud-based access control, raises the risk of market share loss to more technologically advanced competitors, endangering Allegion's long-term relevance and its ability to sustain revenue and earnings growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $172.636 for Allegion based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $4.8 billion, earnings will come to $825.7 million, and it would be trading on a PE ratio of 22.2x, assuming you use a discount rate of 9.0%.

- Given the current share price of $169.97, the analyst price target of $172.64 is 1.5% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.