Last Update 17 Dec 25

Fair value Increased 5.34%CDNA: Raised Revenue Outlook And Buyback Activity Will Support Bullish Repricing

Analysts have nudged their price target on CareDx higher from around 21.83 dollars to 23.00 dollars, citing expectations for slightly faster revenue growth and a richer future valuation multiple, despite a more conservative view on long term profit margins and discount rates.

What's in the News

- The board amended and restated company bylaws to adopt a majority voting standard for director elections, with plurality voting only in contested elections (company bylaws filing).

- The company raised full year 2025 revenue guidance to 372 million to 376 million dollars, up from the prior range of 367 million to 373 million dollars (company guidance).

- The company updated fourth quarter 2025 revenue outlook to 101 million to 105 million dollars, assuming 52,000 to 54,000 tests in the period (company guidance).

- The company completed the repurchase of 1,986,563 shares, about 3.73 percent of shares outstanding, for 25.57 million dollars under the June 2025 buyback program (company buyback update).

- The company published new SHORE registry data showing HeartCare multimodal molecular testing improves prognostic assessment in heart transplant recipients beyond traditional biopsies (clinical study publication).

Valuation Changes

- The fair value estimate has risen slightly from 21.83 dollars to 23.00 dollars per share, reflecting a modestly higher intrinsic value assessment.

- The discount rate has increased slightly from 6.78 percent to about 7.08 percent, implying a marginally higher required return and risk assumption.

- Revenue growth has edged higher from roughly 12.54 percent to about 13.24 percent, indicating modestly stronger top line expectations.

- The net profit margin has fallen significantly from about 16.06 percent to roughly 9.15 percent, signaling a more conservative view on long term profitability.

- The future P/E multiple has risen meaningfully from about 17.7x to roughly 24.4x, implying a richer valuation being applied to projected earnings.

Key Takeaways

- Growing demand for core testing services and expansion into AI-driven diagnostics and digital health are driving recurring, high-margin revenue and supporting improved earnings stability.

- Enhanced payer coverage and operational efficiencies position CareDx for sustained profitability and margin expansion through diversified revenue streams and lower operating costs.

- Shifting reimbursement policies, regulatory uncertainties, and operational risks threaten revenue stability, margins, and the scalability of CareDx's core product-driven business model.

Catalysts

About CareDx- Engages in the discovery, development, and commercialization of diagnostic solutions for transplant patients and caregivers in the United States and internationally.

- The steady double-digit growth in testing volumes, particularly with the expansion of surveillance protocols for kidney, heart, and lung transplants, suggests ongoing market penetration and growing demand for CareDx's core testing services-reflecting the global rise in organ transplants and chronic disease, which is likely to drive future revenue and topline growth.

- The launch of AI-driven diagnostics like AlloSure Plus and integration into electronic health record systems (e.g., EPIC), positions CareDx to benefit from the broader adoption of precision medicine and personalized diagnostics, likely boosting adoption rates, aiding reimbursement, and ultimately supporting net margin improvements.

- Significant progress in payer coverage-including millions of new covered lives, expanded in-network status, and the implementation of a unique CPT code for AlloSure-indicates a catalyst for sustained increases in ASP (average selling price) and recurring revenue streams, which can directly enhance future profitability and margin expansion.

- Expansion of Patient & Digital Solutions and rapid growth in areas such as transplant pharmacy, remote patient monitoring, and digital health software reflects successful diversification of revenue streams tied to healthcare digitization, likely driving high-margin recurring revenues and supporting improved earnings stability.

- Ongoing improvements in operational efficiency-including advancements in revenue cycle management, enhanced claim verification processes, and reduction in claims rejection rates-are expected to further lower operating costs relative to revenue, supporting improved EBITDA, better cash flow, and ultimately, higher net margins.

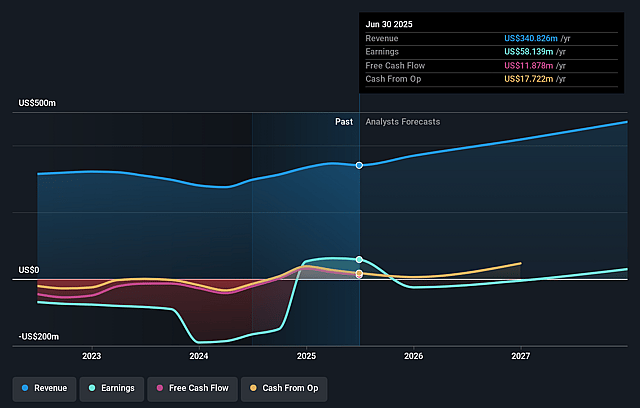

CareDx Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming CareDx's revenue will grow by 12.5% annually over the next 3 years.

- Analysts are not forecasting that CareDx will become profitable in next 3 years. To represent the Analyst Price Target as a Future PE Valuation we will estimate CareDx's profit margin will increase from 17.1% to the average US Biotechs industry of 16.1% in 3 years.

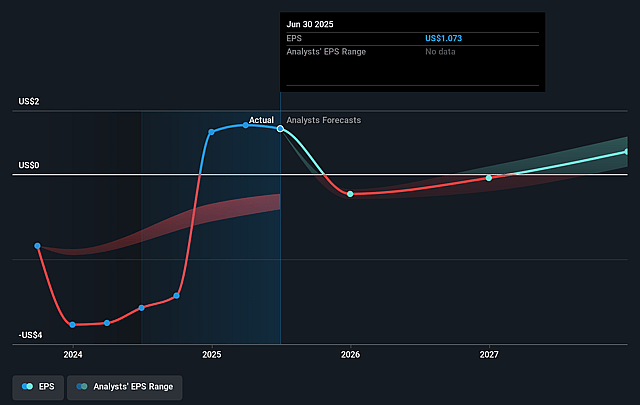

- If CareDx's profit margin were to converge on the industry average, you could expect earnings to reach $78.0 million (and earnings per share of $1.5) by about September 2028, up from $58.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 17.7x on those 2028 earnings, up from 11.7x today. This future PE is greater than the current PE for the US Biotechs industry at 15.5x.

- Analysts expect the number of shares outstanding to decline by 0.76% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

CareDx Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Introduction of bundled payments and frequency limits for surveillance testing under the new draft LCD policy could potentially result in an annual revenue headwind of $15–30 million, directly impacting revenue growth and net margins if finalized as currently proposed.

- Heavy reliance on AlloSure and HeartCare product lines means that any decrease in reimbursement or test volumes due to regulatory or payer changes could significantly compress earnings and threaten long-term profitability.

- Continued uncertainty and potential downward adjustments in Medicare coverage and reimbursement for molecular diagnostic tests represent an enduring risk, as payers seek to control costs amidst industry-wide shifts toward bundled payments and value-based care, which may shrink the company's addressable market and revenues.

- The transition in CFO leadership and possible operational execution risks (such as delays in EPIC integration and scaling digital health rollouts) may disrupt operational momentum and adversely affect margins, cash flow, or long-term scalability if not effectively managed.

- Increased regulatory scrutiny (e.g., around billing, Medicare compliance, or LCD interpretations) and ongoing exposure to one-time revenue write-offs (such as the $3.8 million adjustment this quarter) indicate potential risks of higher SG&A costs, impacting net margins and forward earnings consistency.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $21.833 for CareDx based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $28.0, and the most bearish reporting a price target of just $14.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $485.8 million, earnings will come to $78.0 million, and it would be trading on a PE ratio of 17.7x, assuming you use a discount rate of 6.8%.

- Given the current share price of $12.73, the analyst price target of $21.83 is 41.7% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on CareDx?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.