Last Update 23 Nov 25

Fair value Increased 0.069%FANG: Operational Strength And Asset Sales Are Expected To Drive Shareholder Returns

Diamondback Energy’s analyst price target has seen a minimal change, rising slightly from approximately $178.31 to $178.43 per share as analysts factor in updated sector models and company performance following recent earnings.

Analyst Commentary

Recent research commentary reflects a blend of optimism and caution regarding Diamondback Energy’s near-term outlook. Analysts continue to monitor the company’s operating performance, valuation, and the broader sector environment as price targets are adjusted in response to earnings updates and changing macro conditions.

Bullish Takeaways- Bullish analysts continue to see upside in Diamondback Energy’s shares, raising price targets in response to stronger than expected Q3 production and cash flow that outperformed consensus estimates.

- The company’s operational efficiencies and cost controls are trending positively. This supports favorable shareholder return policies and capital allocation strategies.

- Some analysts anticipate the maintenance of steady production profiles and expect share buybacks to continue. This reinforces management’s disciplined approach to commodity market uncertainty.

- Forecast revisions are generally above consensus, suggesting that updated models reflect a positive view of Diamondback’s execution and outlook relative to broader industry expectations.

- Bearish analysts have trimmed price targets in response to macro challenges, with ongoing concerns about a less favorable oil environment and weaker expected realizations in gas and NGL segments.

- Preliminary guidance for 2025 and 2026 has prompted downward revisions to valuation models. Slower sector growth and subdued cash flows continue to weigh on sentiment.

- There is some skepticism regarding the sustainability of recent rallies in gas equities. Select major firms maintain a preference for gas stocks over oil.

- Certain analysts note industry estimates remain "disappointing" compared to margin indicators. This introduces caution around future growth prospects, despite recent outperformance.

What's in the News

- Viper Energy, the mineral and royalty business of Diamondback Energy, is considering the sale of non-Permian assets that were part of its recent $4.1 billion acquisition of Sitio Royalties (Bloomberg).

- Diamondback Energy CEO Kaes Van't Hof stated that U.S. oil output growth will stall if prices remain around $60 per barrel, citing profitability challenges at lower price points (Reuters).

- The owners of the EPIC Crude pipeline, including Diamondback Energy, are exploring a sale that could value the asset at approximately $3 billion, with negotiations currently underway (Reuters).

Valuation Changes

- Consensus Analyst Price Target has risen slightly, moving from approximately $178.31 to $178.43 per share.

- Discount Rate has decreased modestly from 7.23% to 6.96%, reflecting revised risk assumptions.

- Revenue Growth projections have fallen significantly, dropping from 4.00% to 1.69%.

- Net Profit Margin expectations have increased from 27.38% to 29.11%, indicating improved operational performance.

- Future P/E multiple forecasts have declined from 15.01x to 13.51x. This suggests lower valuation expectations relative to projected earnings.

Key Takeaways

- Successful Permian Basin consolidation and operational efficiency drive sustainable cost reductions, higher margins, and resilient cash flow amid oil market volatility.

- Strategic asset sales and disciplined capital allocation strengthen the balance sheet, reduce risk, and set the stage for enhanced shareholder returns and production growth.

- Rising operating costs, lower quality drilling inventory, oil price volatility, diminishing efficiency gains, and limited quality acquisitions threaten long-term profitability and revenue growth.

Catalysts

About Diamondback Energy- An independent oil and natural gas company, acquires, develops, explores, and exploits unconventional, onshore oil and natural gas reserves in the Permian Basin in West Texas.

- Ongoing consolidation in the Permian Basin, with Diamondback positioned as the "consolidator of choice" due to its industry-best integration, low cost structure, and ability to deliver synergies from recent large acquisitions (e.g., Double Eagle, Endeavor), supports future growth in scale, cost savings, and higher EBITDA margins.

- Consistent operational efficiency improvements (record drilling times, workover programs, optimization of older wells, and improved gas capture) point to sustainable cost reductions and productivity enhancements, supporting resilient net margins and robust free cash flow even in a volatile oil price environment.

- Anticipated noncore asset sales (targeting $1.5 billion), debt paydown, and enhanced balance sheet flexibility will lower interest expenses, reduce financial risk, and ultimately enable increased shareholder returns via buybacks/dividends, directly impacting future EPS and total returns.

- The company's ability to exploit emerging zones within its existing acreage (such as Wolfcamp B/D and others) without performance degradation, combined with the long-term, favorable trend of underinvestment and growing global oil demand, supports stable or growing production volumes and revenue over the next several years.

- Diamondback's focus on domestic energy security and operational discipline aligns with growing policy support and infrastructure investment, helping maintain or expand market share, and positioning the company to benefit disproportionately from secular demand for reliable U.S. oil supply-positively impacting long-term revenue and earnings resilience.

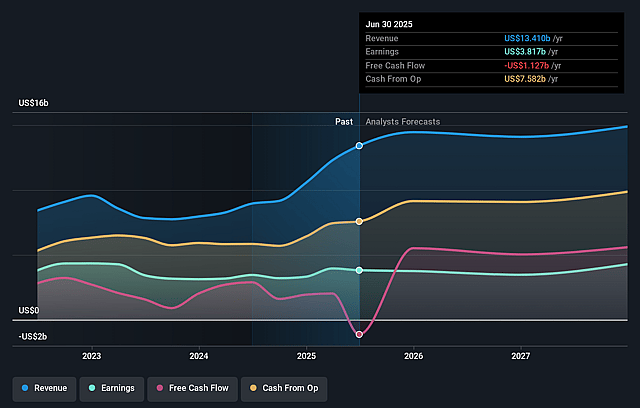

Diamondback Energy Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Diamondback Energy's revenue will grow by 5.2% annually over the next 3 years.

- Analysts are assuming Diamondback Energy's profit margins will remain the same at 28.5% over the next 3 years.

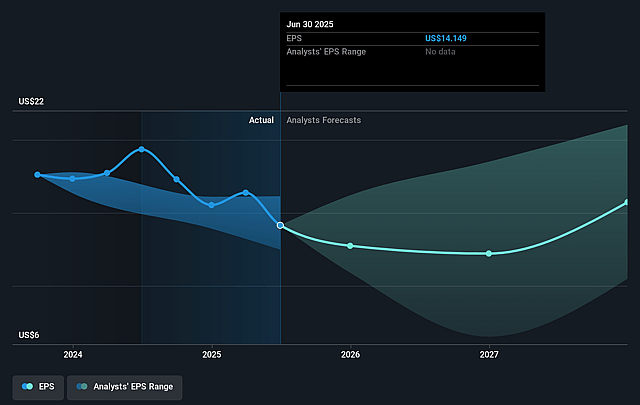

- Analysts expect earnings to reach $4.5 billion (and earnings per share of $16.47) by about September 2028, up from $3.8 billion today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $5.8 billion in earnings, and the most bearish expecting $2.9 billion.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 14.3x on those 2028 earnings, up from 10.3x today. This future PE is greater than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 0.86% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.44%, as per the Simply Wall St company report.

Diamondback Energy Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Increasing water management and disposal costs, coupled with electricity and power inflation in the Permian Basin, could significantly raise Diamondback's long-term operating expenses (LOE), thereby pressuring net margins and EBITDA.

- The company's development mix is increasingly shifting toward secondary and non-core zones as top-tier acreage becomes scarcer, risking declining well productivity and higher per-barrel costs in the future, which may erode long-term earnings resilience.

- Persistent uncertainty around oil price volatility and macroeconomic headwinds-combined with significant exposure to commodity price swings due to a less robust hedge position for 2026 and beyond-could impair future revenues, free cash flow, and the sustainability of shareholder returns if prices fall.

- Industry-wide efficiency gains and cost reductions are showing signs of plateauing, while supply chain risks (such as casing tariffs and steel cost inflation) could limit further margin improvements, challenging Diamondback's ability to maintain its cost leadership and robust capital efficiency over the long term.

- Limited inventory of high-quality, accretive acquisition targets in the Permian and growing competition among consolidators heighten the risk that future M&A will be either value-dilutive or unattainable, leading to slower production growth, less scale advantage, and increased reliance on organic opportunities which may yield lower returns and impact long-term revenue growth.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $182.0 for Diamondback Energy based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $222.0, and the most bearish reporting a price target of just $143.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $15.6 billion, earnings will come to $4.5 billion, and it would be trading on a PE ratio of 14.3x, assuming you use a discount rate of 7.4%.

- Given the current share price of $136.29, the analyst price target of $182.0 is 25.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.