Last Update 28 Oct 25

Fair value Increased 2.92%First Hawaiian’s analyst price target has been raised from $26.13 to $26.89. Analysts cite improved earnings projections supported by higher net interest income, stronger fees, and lower non-interest expenses.

Analyst Commentary

Analysts have updated their perspectives on First Hawaiian in light of recent quarterly results, offering insights into both the strengths and challenges facing the company.

Bullish Takeaways

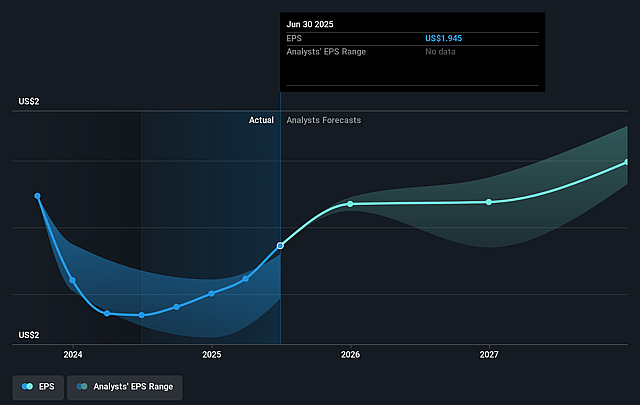

- Bullish analysts are raising earnings per share forecasts through 2027, reflecting expectations for sustained growth in profitability.

- Recent improvements in net interest income are enhancing core revenue generation and supporting a higher valuation outlook.

- Strength in fee income suggests diversified revenue streams, which contribute to increased resilience in various market conditions.

- Lower non-interest expenses are boosting operating efficiency and signaling effective cost controls and improved execution.

Bearish Takeaways

- Despite a higher price target, some analysts maintain a neutral view due to limited upside potential relative to recent share price movements.

- Concerns remain about the sustainability of improved net interest income if market conditions shift.

- Growth projections, while raised, are still tempered by cautious assumptions about the pace of fee income expansion and cost management.

- Wider industry headwinds and regulatory risks continue to weigh on sentiment and make further meaningful upticks in valuation more challenging.

What's in the News

- From July 1, 2025 to September 30, 2025, First Hawaiian repurchased 964,000 shares for $24 million, completing the buyback of 2,980,521 shares totaling $74.21 million as part of a program announced on January 31, 2025 (Key Developments).

- Net charge-offs for the third quarter ended September 30, 2025, were $4.2 million, or 0.12% of average loans and leases annualized. This is up from $3.3 million, or 0.09%, in the previous quarter (Key Developments).

Valuation Changes

- The consensus analyst price target has risen slightly from $26.13 to $26.89.

- The discount rate remains unchanged at 6.78%.

- The revenue growth estimate has increased modestly from 5.76% to 5.95%.

- The net profit margin has improved from 27.71% to 29.97%.

- The future P/E ratio has declined from 13.86x to 12.48x, indicating a lower valuation relative to projected earnings.

Key Takeaways

- Expanding population, tourism, and digital banking adoption are driving stronger loan demand, operational efficiency, and improved margins.

- Conservative risk management and sustainable finance initiatives are supporting asset quality, resilience, and new growth opportunities.

- Geographic concentration, deposit outflows, stagnant loan growth, rising competition, and increasing credit risk threaten long-term stability, earnings, and asset quality.

Catalysts

About First Hawaiian- Operates as a bank holding company for First Hawaiian Bank that provides a range of banking products and services to consumer and commercial customers in the United States.

- The ongoing expansion in Hawaii's population and consistently rising tourism spending are supporting stable to growing demand for loans and banking services, which should lead to gradually increasing loan balances and higher fee-based revenue over time.

- Strategic investments and progress in digital banking adoption are enabling First Hawaiian to maintain expense discipline, streamline operations, and attract and retain younger customers, which will likely support margin improvement and cost-to-income ratio reduction.

- The bank's robust deposit franchise, underpinned by a strong local brand and deep customer relationships, has allowed for stable deposit growth and maintained a high proportion of noninterest-bearing deposits-putting First Hawaiian in a favorable position to benefit from net interest margin expansion as interest rates normalize.

- Continued focus on conservative underwriting and close management of credit risk is resulting in superior asset quality and minimal loan losses, contributing to more resilient future earnings even through credit cycles.

- Efforts in sustainable finance and green lending position First Hawaiian to capture new business opportunities as local businesses and governments invest in environmentally sustainable infrastructure, creating new revenue streams and enhancing long-term fee income.

First Hawaiian Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming First Hawaiian's revenue will grow by 5.8% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 30.6% today to 27.7% in 3 years time.

- Analysts expect earnings to reach $263.9 million (and earnings per share of $2.2) by about September 2028, up from $246.5 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 13.9x on those 2028 earnings, up from 13.0x today. This future PE is greater than the current PE for the US Banks industry at 11.9x.

- Analysts expect the number of shares outstanding to decline by 2.55% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 6.78%, as per the Simply Wall St company report.

First Hawaiian Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Continued declines in commercial and retail deposits, as noted in the quarter, could become a longer-term trend if customer preferences shift toward fintechs or online banks, potentially impacting stable funding sources and compressing net interest margins and earnings.

- Persistent reliance on the Hawaiian regional economy, with repeated references to local economic factors and the management's reluctance to forecast long-term growth, highlights geographic concentration risk that could expose revenue and earnings to tourism slowdowns, demographic shifts, or regional downturns.

- The reduction in loan growth guidance from low

- to mid-single digits down to low single digits, as well as construction loan paydowns and stabilization (rather than growth) of key loan portfolios, could signal a maturing or stagnating balance sheet, limiting long-term revenue and earnings expansion.

- Increasing competition for construction loan takeouts from institutional buyers and insurance companies may result in more loans being refinanced away from First Hawaiian, reducing loan balances and associated interest income over time.

- The CFO's comments on persistent, albeit small, increases in nonperforming residential loans and consumer financial strain suggest rising credit risk at the lower end of the market, which, if it becomes a structural issue, may lead to higher loan losses and negatively impact net income and asset quality.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $26.125 for First Hawaiian based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $952.3 million, earnings will come to $263.9 million, and it would be trading on a PE ratio of 13.9x, assuming you use a discount rate of 6.8%.

- Given the current share price of $25.71, the analyst price target of $26.12 is 1.6% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.