Key Takeaways

- Demand for secure government-leased properties supports stable revenue, high occupancy, and portfolio growth through long-term, non-cancelable leases.

- Conservative financial management and focus on essential, resilient tenants provide flexibility, stability, and strong investor appeal in uncertain markets.

- Pressure from elevated capital costs, cautious acquisitions, evolving government tenant needs, and weak investor sentiment may constrain long-term growth and compress margins despite near-term portfolio stability.

Catalysts

About Easterly Government Properties- Easterly Government Properties, Inc. (NYSE: DEA) is based in Washington, D.C., and focuses primarily on the acquisition, development and management of Class A commercial properties that are leased to the U.S.

- Persistent demand for mission-critical, secure, and specialized facilities by federal agencies-such as courthouses, law enforcement labs, and public health clinics-continues to underpin high occupancy and stable rental income for Easterly, which directly supports long-term revenue stability and growth.

- The federal government's ongoing modernization and renewal of real estate procurement-as evident from recent multi-year lease renewals with built-in rent escalators-positions Easterly to capture rent growth and maintain high tenant retention, positively influencing both revenue and net operating income.

- Easterly's disciplined approach to acquiring and developing properties tailored to evolving government agency needs, with over $1 billion in high-quality pipeline opportunities and a focus on non-cancelable, long-term leases, supports the expansion of the portfolio and future earnings growth.

- Conservative balance sheet management-including targeted leverage ratios and a significant liquidity cushion-provides operational flexibility for selective investments while insulating cash flows and net margins from interest rate volatility.

- Institutional appetite for stable, government-backed income streams remains strong; as market uncertainty persists, Easterly's focus on essential, long-lease government tenants should drive demand for its properties, supporting property values, occupancy levels, and potentially aiding in future earnings growth.

Easterly Government Properties Future Earnings and Revenue Growth

Assumptions

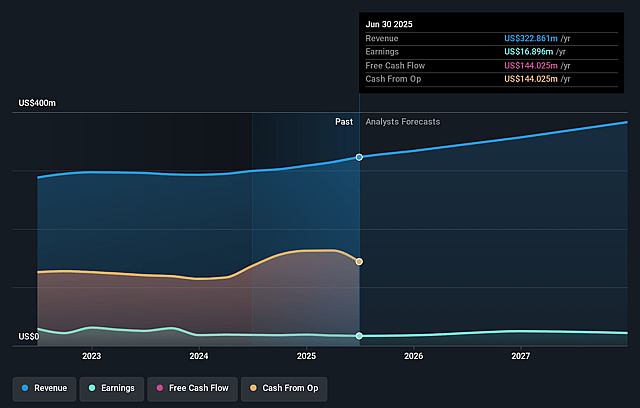

How have these above catalysts been quantified?- Analysts are assuming Easterly Government Properties's revenue will grow by 7.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 5.2% today to 5.1% in 3 years time.

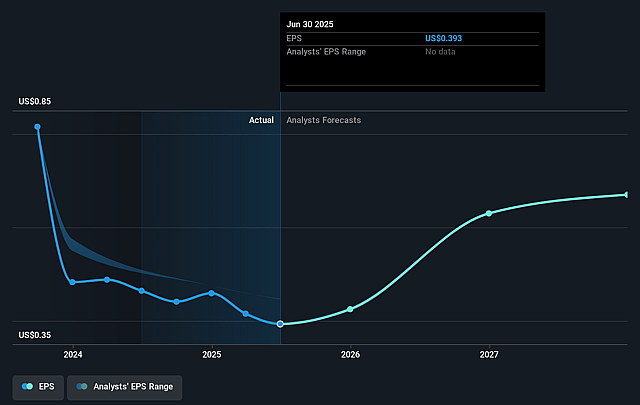

- Analysts expect earnings to reach $20.4 million (and earnings per share of $0.69) by about September 2028, up from $16.9 million today. However, there is some disagreement amongst the analysts with the more bullish ones expecting earnings as high as $24.7 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 94.3x on those 2028 earnings, up from 61.1x today. This future PE is greater than the current PE for the US Office REITs industry at 37.8x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.41%, as per the Simply Wall St company report.

Easterly Government Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The company's elevated cost of capital, highlighted by management as "modestly challenging" and "in the 8s today," suggests that future property acquisitions and development projects may deliver lower returns, potentially constraining earnings growth and pressuring net margins if capital markets remain tight or interest rates rise further.

- The near-term "overhang from our dividend reset earlier this year" has impacted investor sentiment, indicating a risk that Easterly must rebuild long-term capital support; persistent weakness in shareholder base growth or lack of investor confidence may limit funding for future expansion and negatively affect both revenue and FFO growth.

- Despite describing its real estate as "mission-critical," the company acknowledges that federal and state government tenants are moving toward "streamlining of agency footprints" and "modernizing its approach to real estate procurement," signaling an industry-wide trend toward space optimization and cost-consciousness that could translate into government lease reductions or terminations, thereby reducing occupancy rates and rental income.

- Management's deliberate emphasis on "selectivity" and limited pipeline execution, even with $1–1.5 billion in deal flow, suggests a potentially slower pace of acquisitions and development due to heightened competition for quality assets and more stringent underwriting, possibly restricting long-term portfolio and earnings growth.

- Easterly's high reliance on long-term, fixed-rate leases with government tenants-while offering near-term stability-carries the risk that future inflationary pressures may not be fully offset by limited built-in rent escalators, compressing net margins and reducing real earnings growth in a rising cost environment.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $24.083 for Easterly Government Properties based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $403.5 million, earnings will come to $20.4 million, and it would be trading on a PE ratio of 94.3x, assuming you use a discount rate of 9.4%.

- Given the current share price of $22.8, the analyst price target of $24.08 is 5.3% higher. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.