Last Update04 Oct 25Fair value Increased 2.56%

Scorpio Tankers' analyst price target has been raised by analysts from approximately $65.11 to $66.78. The increase is attributed to improved asset values, stronger profit margins, and enhanced cash generation prospects, despite adjustments for a smaller fleet and updated revenue forecasts.

Analyst Commentary

Recent analyst updates reflect a nuanced view of Scorpio Tankers' financial and strategic position, with attention to evolving market conditions, asset values, and fleet adjustments. While there are positive signals driving increased price targets, a combination of operational factors and revenue projections has also prompted analysts to note potential risks and limitations.

Bullish Takeaways

- Bullish analysts highlight an increased price target, justified by improved asset values and strengthened cash generation prospects.

- The company's actions to reduce its net debt position, following the sale of vessels, are viewed as significant for supporting balance sheet strength and future flexibility.

- Accelerating cash generation is anticipated from seasonally stronger product tanker rates, particularly going into the fourth quarter.

- Asset sales are expected to enhance valuation metrics, even as the overall fleet size is marginally reduced.

Bearish Takeaways

- Bearish analysts are lowering revenue estimates for 2025 and 2026, reflecting a smaller fleet and reduced revenue days.

- Recent softer product tanker rates are cited as a headwind, impacting short-term earnings visibility and top-line growth.

- Despite the rise in price target, some analysts maintain a more cautious rating, emphasizing uncertainty tied to market cycles and sector volatility.

- Sustaining growth and valuation upside will depend on successful execution against fleet adjustments and adaptation to shifting demand trends.

What's in the News

- M&A-focused Betaville blog highlighted a rumor involving Scorpio Tankers for its subscribers (Betaville via The Fly).

- Scorpio Tankers announced an agreement to sell the 2020-built, scrubber-fitted MR product tanker STI Maestro for $42 million, with the sale expected to close in the fourth quarter of 2025 (Client Announcement).

- Carbon Ridge and Scorpio Tankers have successfully completed the first deployment of a centrifugal onboard carbon capture system (OCCS) on an LR2 product tanker. This marks a shipping industry first (Product-Related Announcement).

- The company completed the repurchase of over 12.7 million shares, representing nearly 24% of total shares, for $730.19 million under the share buyback program announced in February 2023 (Buyback Tranche Update).

Valuation Changes

- Consensus Analyst Price Target has risen slightly, increasing from $65.11 to $66.78 per share.

- Discount Rate has fallen moderately, dropping from 9.65% to 9.41%.

- Revenue Growth projections have increased significantly, moving from 2.0% to 3.7%.

- Net Profit Margin has improved, rising from 31.13% to 35.22%.

- Future P/E ratio has declined, moving from 12.48x to 10.45x. This suggests a lower expected valuation multiple.

Key Takeaways

- Structural shifts in global refining and trade flows are boosting demand for Scorpio's fleet, supporting stronger freight rates and long-term revenue growth.

- Scorpio's young, efficient fleet and improved balance sheet enable market share gains, premium rates, shareholder returns, and resilience to regulatory changes.

- Structural shifts toward cleaner energy, regulatory and geopolitical risks, aging fleet challenges, and potential overcapacity all threaten long-term profitability and earnings stability.

Catalysts

About Scorpio Tankers- Engages in the seaborne transportation of crude oil and refined petroleum products worldwide.

- Structural changes in global refining – including ongoing refinery closures in Europe and North America and limited new capacity additions – are increasing the average distance and complexity of refined products trade, which is steadily raising ton-mile demand and supporting higher utilization rates for Scorpio's modern fleet. This dynamic is likely to drive revenue growth and support long-term rate strength.

- The global build-out of refinery capacity in Asia and the Middle East, coupled with persistent demand for refined petroleum (as seen in rising exports and low inventories), is accelerating regional trade dislocations. This increases the need for long-haul product movements, directly benefiting Scorpio's exposure with longer voyages and enhanced freight rates-positively impacting both revenue and future EBITDA margins.

- Industry-wide fleet aging, together with stricter environmental regulations and limited new ordering activity, is constraining effective supply growth. Scorpio's young, fuel-efficient fleet stands to capture market share and command premium rates as older vessels lose utilization, thereby supporting net margins and sustained earnings growth.

- Scorpio's balance sheet transformation-with net debt reduced by $2.5 billion since late 2021 and strong current liquidity-provides the company with strategic flexibility to capitalize on favorable market conditions, selectively deploy capital, and pursue opportunistic shareholder returns (buybacks/dividends), all of which underpins future earnings growth and potential valuation re-rating.

- Ongoing operational efficiency improvements, driven by proactive vessel maintenance, digitalization, and pilot adoption of emission-reducing technologies, are lowering operating expenses and vessel off-hire days. These initiatives are likely to increase EBITDA margins and resilience to regulatory changes, supporting long-term free cash flow generation.

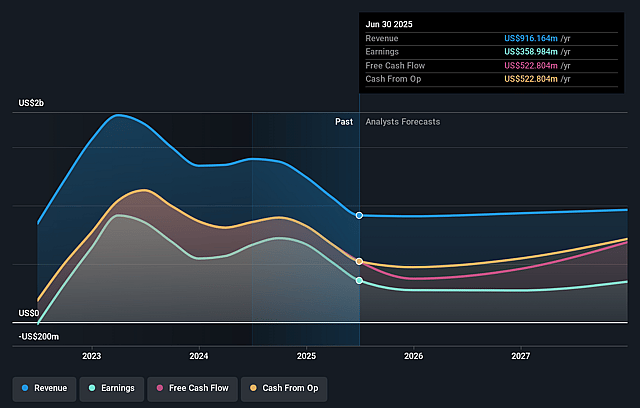

Scorpio Tankers Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Scorpio Tankers's revenue will grow by 2.0% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 39.2% today to 31.1% in 3 years time.

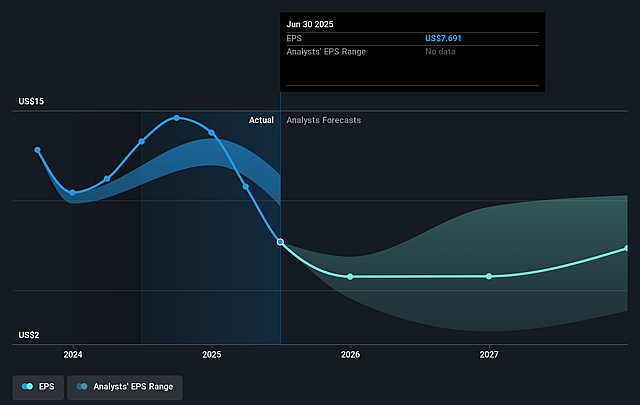

- Analysts expect earnings to reach $302.6 million (and earnings per share of $7.29) by about September 2028, down from $359.0 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $483.9 million in earnings, and the most bearish expecting $185.5 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 12.5x on those 2028 earnings, up from 7.5x today. This future PE is lower than the current PE for the US Oil and Gas industry at 12.6x.

- Analysts expect the number of shares outstanding to decline by 1.97% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 9.65%, as per the Simply Wall St company report.

Scorpio Tankers Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- The ongoing global energy transition and increasing regulatory pressures (e.g., carbon taxes, emissions standards) could lead to a structural decline in demand for refined oil products, directly limiting the long-term need for Scorpio Tankers' services and potentially reducing fleet utilization, impacting long-term revenue growth.

- The product tanker order book, currently at 20% of the existing fleet, paired with periods of heightened ordering or overbuilding in response to market strength, carries the risk of future overcapacity. This could exert downward pressure on day rates and compress Scorpio's earnings and net margins once new deliveries hit the water.

- Heightened geopolitical uncertainty-including unresolved tensions in Russia-Ukraine, Middle East instability, and the risk of increased sanctions or trade restrictions-could lead to trade disruptions, higher insurance and compliance costs, or reduced shipping opportunities, thereby impacting operational efficiency and increasing opex, with knock-on effects for net margins.

- As the fleet ages, OpEx and maintenance costs tend to rise over time despite recent efficiency gains from dry docks and special surveys; if Scorpio does not adequately renew or modernize its fleet in the face of stricter environmental standards, it may face significant future capex needs, impacting free cash flow, increasing depreciation, and lowering net income.

- A substantial portion of Scorpio's business remains exposed to spot market volatility. Should industry cycles soften or oil demand dip due to secular trends (including oil substitution and growth in electric vehicles), Scorpio may experience increased revenue and earnings volatility, with pressure on net margins and overall return on equity.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $65.111 for Scorpio Tankers based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $75.0, and the most bearish reporting a price target of just $54.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $972.2 million, earnings will come to $302.6 million, and it would be trading on a PE ratio of 12.5x, assuming you use a discount rate of 9.7%.

- Given the current share price of $57.13, the analyst price target of $65.11 is 12.3% higher. Despite analysts expecting the underlying buisness to decline, they seem to believe it's more valuable than what the market thinks.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.