Last Update 21 Jan 26

Fair value Decreased 2.78%ROP: Recurring Software Cash Flows And First Buyback Will Support Future Compounding

Narrative Update

The analyst price target for Roper Technologies has been reduced from about US$563.81 to about US$548.13 as analysts factor in more conservative revenue growth assumptions, a slightly higher discount rate, and a lower future P/E multiple, while still recognizing resilient margins and recurring software cash flows highlighted in recent research.

Analyst Commentary

Recent research on Roper Technologies reflects a mix of optimism about the company’s software driven model and caution around near term growth constraints, tariff effects, and shifting investor preferences. Price targets have generally been revised lower, even as many analysts maintain positive views on the quality of the business and its cash generation.

Bullish Takeaways

- Bullish analysts highlight Roper’s evolution into a vertical software franchise across healthcare, education, financial services and logistics, which they see as supporting recurring revenue and free cash flow durability.

- Several positive views point to Q3 metrics such as 6% organic growth, better EPS versus estimates and strong free cash flow as signs that core execution and underlying demand remain intact despite external headwinds.

- Some bullish analysts stress that issues around government shutdowns and copper tariffs at Deltek and Neptune look more like timing related conversion challenges rather than demand erosion, which they see as manageable for long term growth.

- The authorization of a US$3b share buyback is seen by supportive analysts as a shareholder friendly use of capital that can help support valuation if cash generation stays consistent with past commentary.

Bearish Takeaways

- Bearish analysts, including JPMorgan, have cut price targets, reflecting more conservative assumptions on revenue trajectories, a slightly higher discount rate and lower future P/E multiples, which collectively pressure valuation.

- Several cautious views focus on Q3 and FY25 updates, where organic growth missed consensus, guidance for organic revenue growth was trimmed to about 6% year over year and 2025 organic growth expectations were narrowed lower, raising questions on the near term growth profile.

- Some bearish analysts flag that artificial intelligence could challenge Roper’s diversified application software model, potentially affecting the durability of its competitive position and the premium multiple previously assigned.

- There is also concern that current investor preference for higher beta, more cyclical names limits relative share price upside for a higher quality, recurring revenue compounder, even if fundamentals remain solid, which feeds into more measured target prices.

What's in the News

- The board declares a quarterly cash dividend of US$0.91 per share for payment on January 16, 2026 to stockholders of record on January 2, 2026. This is described as a 10% increase versus the prior quarterly dividend and the thirty third consecutive year of dividend increases (Key Developments).

- The company announces a share repurchase program authorizing up to US$3.0b of common share buybacks, with the stated goal of creating shareholder value (Key Developments).

- The board authorizes the first share repurchase plan on October 23, 2025, aligning with the US$3.0b buyback authorization disclosed by the company (Key Developments).

- Management states on the earnings call that total revenue grew 14%, organic revenue grew 6%, software bookings were in the high single digit range, free cash flow grew 17% and free cash flow margins were 32% for the trailing twelve month period, and reiterates a focus on M&A for faster growth platforms and tuck in deals (Key Developments).

- The company issues guidance for Q4 2025 GAAP diluted EPS of US$3.59 to US$3.64 and full year 2025 GAAP diluted EPS of US$13.86 to US$13.91, with expectations for total revenue growth of about 13% and organic revenue growth of about 6% (Key Developments).

Valuation Changes

- Fair Value: revised from about US$563.81 to about US$548.13, indicating a modestly lower assessed price level.

- Discount Rate: adjusted slightly from about 9.01% to about 9.03%, implying a small change in the required return input.

- Revenue Growth: updated from about 12.17% to about 11.20%, reflecting more conservative top line assumptions.

- Net Profit Margin: moved from about 19.83% to about 20.95%, indicating a higher expected profitability level in the model.

- Future P/E: reduced from about 36.51x to about 34.51x, pointing to a lower valuation multiple assumption on future earnings.

Key Takeaways

- Accelerating adoption of AI-driven, vertical-specific SaaS platforms is expanding margins, boosting subscription revenue stability, and fueling long-term organic growth.

- Significant opportunity remains in under-digitized, data-rich sectors, supporting ongoing market share gains and recurring revenue expansion as digital transformation advances.

- Heavy dependence on acquisitions and niche markets, alongside regulatory, technological, and integration risks, threatens Roper's margin sustainability and future organic revenue growth.

Catalysts

About Roper Technologies- Designs and develops vertical software and technology enabled products in the United States, Canada, Europe, Asia, and internationally.

- The rapid adoption of AI and cloud-native solutions across Roper's portfolio is unlocking significant productivity gains (cited 30% R&D productivity increase in some business units) and enabling monetization of new, AI-driven products and upgrades, which is expected to accelerate organic revenue growth and expand operating margins over time.

- Penetration of under-digitized, data-rich sectors-including faith-based organizations, healthcare, legal, and government contracting-remains nascent, with large TAMs only 50% served in some cases (e.g., Subsplash), indicating substantial runway for recurring revenue and market share gains as digital transformation accelerates within these verticals.

- Increased focus on integrating mission-critical, vertical-specific SaaS platforms that combine software, payments, and network effects is driving higher gross/net customer retention, enabling a higher mix of stable, subscription-based revenues, which enhances earnings predictability and cash flow stability.

- Ongoing, disciplined capital deployment into high-growth, high-margin vertical market software leaders (e.g., Subsplash, CentralReach) is incrementally raising the portfolio's underlying organic growth rate and long-term margin profile, supporting robust free cash flow compounding and the potential for EBITDA margin expansion.

- Secular increases in data proliferation, automation needs, and regulatory complexity, especially within healthcare and compliance-driven segments, are fueling demand for analytics-rich, secure, and integrated software solutions-well aligned with Roper's core offerings, underpinning sustainable revenue growth and margin resilience.

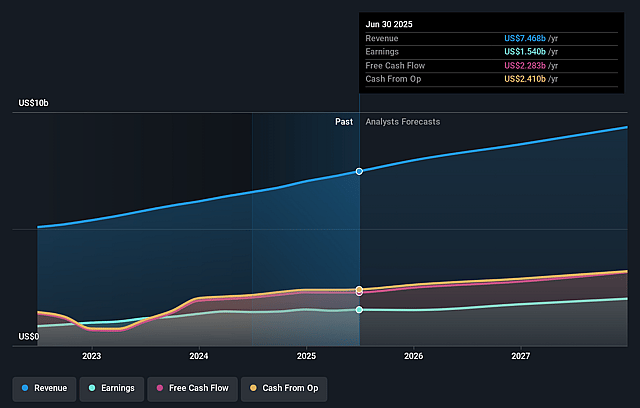

Roper Technologies Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Roper Technologies's revenue will grow by 11.0% annually over the next 3 years.

- Analysts assume that profit margins will increase from 20.6% today to 21.1% in 3 years time.

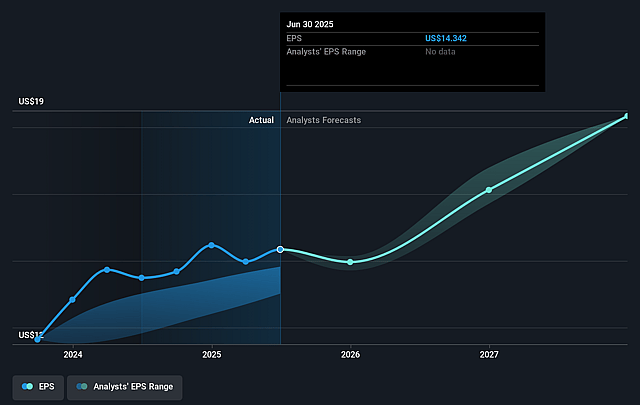

- Analysts expect earnings to reach $2.2 billion (and earnings per share of $19.59) by about September 2028, up from $1.5 billion today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 41.1x on those 2028 earnings, up from 36.3x today. This future PE is greater than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to grow by 0.36% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.86%, as per the Simply Wall St company report.

Roper Technologies Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Roper's continued reliance on M&A-driven growth, as evidenced by their focus on acquiring vertical market software businesses (e.g., CentralReach, Subsplash), increases the risk of integration challenges and may lead to operational inefficiencies or diluted net margins over time, as shown by initial underperformance at Procare and related management turnover.

- The company's outlook assumes market stability and ongoing organic growth in niche verticals such as education, legal, and faith-based organizations; however, these markets may approach saturation, resulting in slowing organic revenue growth and limiting the company's ability to sustain its historic top-line trajectory.

- The rising complexity of regulatory requirements (e.g., healthcare coverage changes, potential government spending volatility) and increased scrutiny on data privacy and cybersecurity could raise compliance costs, expose the company to reputational or operational risk, and negatively impact earnings and margin profiles for its software platforms.

- Intensifying competition and rapid technological change in the software sector-especially from large enterprise software providers and new entrants offering more advanced AI capabilities-pose a threat to Roper's market share, pricing power, and may require increased R&D investment just to maintain current revenue streams.

- The risk of commoditization in business software, particularly as clients expect more AI-native or cloud-integrated solutions, may lead to downward pressure on pricing and margins if Roper is unable to sustain differentiated value, impacting both future revenue growth and long-term net margins.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $636.2 for Roper Technologies based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $714.0, and the most bearish reporting a price target of just $460.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $10.2 billion, earnings will come to $2.2 billion, and it would be trading on a PE ratio of 41.1x, assuming you use a discount rate of 8.9%.

- Given the current share price of $519.67, the analyst price target of $636.2 is 18.3% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Roper Technologies?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.