Last Update 06 Jan 26

Fair value Increased 2.05%CDE: Diversified Mines And Exploration Program Will Support Future Upside Potential

Analysts have raised their fair value estimate for Coeur Mining to about $21.29 from $20.86. The change reflects updated price targets ranging from $16 to $21 and ongoing discussion of the company's mine portfolio, exploration plans, and valuation following a strong share price rally.

Analyst Commentary

Recent Street research on Coeur Mining reflects a mixed view, with some analysts highlighting growth potential and others focusing on valuation after a strong share price move.

Bullish Takeaways

- Bullish analysts point to Coeur's diversified portfolio of four mines with what they view as lower jurisdictional risk, which they see as supportive for execution and operational stability.

- Being described as one of the world's largest primary silver producers and a significant gold producer, Coeur is seen by bullish analysts as having meaningful scale in both metals, which they link to potential revenue resilience.

- The company's aggressive exploration budget aimed at improving reserve life is viewed positively for long term production visibility and potential growth in resources.

- Some bullish analysts maintain price targets around US$21, suggesting they still see room within their valuation frameworks despite recent volatility in the shares.

Bearish Takeaways

- Bearish analysts have shifted ratings down from Buy to more neutral stances, citing the strong year to date rally of about 208% and describing the shares as fully and fairly valued at current levels.

- Even where targets move higher, such as to US$16, cautious analysts argue that the current share price already reflects optimism about execution and growth, leaving less room for upside in their models.

- Some bearish analysts have trimmed price targets, for example to US$21 from US$22, framing this as a recalibration after reviewing Q3 results and valuation assumptions.

- Overall, the shift toward Hold or Market Perform ratings suggests that cautious analysts see a more balanced risk reward profile after the recent rally, with less emphasis on further re rating and more on delivery against existing plans.

What’s in the News

- Coeur Mining has called a special or extraordinary shareholders meeting for January 27, 2026. This signals items for investor approval that go beyond routine annual business.

- At this special meeting, the company is proposing an amendment to its Certificate of Incorporation, which would adjust elements of its corporate bylaws or capital structure.

- The company provided updated 2025 production guidance, refining expected full year gold output to 392,500 to 438,000 ounces and silver output to 17,100,000 to 19,150,000 ounces. The midpoints are 415,250 ounces for gold and 18,100,000 ounces for silver (Corporate guidance).

- Coeur reported unaudited Q3 2025 production of 111,364 ounces of gold and 4.8 million ounces of silver, with both metals above the levels reported a year earlier (Q3 2025 operating results).

- Between July 1 and September 30, 2025, the company repurchased 451,700 shares for US$5.33 million. This brings total buybacks under the May 27, 2025 authorization to 668,200 shares for US$7.33 million (Buyback tranche update).

Valuation Changes

- Fair Value Estimate: Adjusted from about US$20.86 to about US$21.29 per share, reflecting a small upward move in the modelled valuation.

- Discount Rate: Refined from 8.16% to 8.18%, indicating only a very minor change in the assumed risk profile.

- Revenue Growth: Kept effectively unchanged at about 14.45% in the forward assumptions.

- Profit Margin: Held steady at roughly 38.07%, suggesting no material shift in margin expectations in the latest update.

- Future P/E: Updated from about 17.76x to about 18.13x, indicating a modestly higher multiple applied to projected earnings.

Key Takeaways

- Rising industrial and investor demand for silver and gold, along with operational improvements, position the company for strong revenue growth and margin expansion.

- Exploration and asset integration efforts are set to extend mine life and underpin stable long-term production.

- Greater regulatory, operational, and financial risks may constrain growth, pressure margins, and jeopardize long-term profitability and cash flow stability.

Catalysts

About Coeur Mining- Operates as a gold and silver producer in the United States, Canada, and Mexico.

- The company is set to benefit from anticipated sustained demand growth for silver, underpinning future topline revenue expansion, as global electrification and clean energy adoption drive higher usage of silver in solar panels, batteries, and EVs.

- Persistent inflationary pressures and ongoing geopolitical uncertainty continue to bolster investor demand for gold and silver as safe-haven assets, which could lead to higher realized prices and expanded net margins for Coeur.

- The successful ramp-up and integration of the Rochester expansion and Las Chispas asset are driving significant increases in silver and gold production, positioning Coeur for robust revenue and earnings growth in the near to medium term.

- Strengthened operational efficiencies-reflected in declining cost applicable to sales per ounce and process improvements at key mines-are improving operating leverage and could further support margin expansion and cash generation.

- Aggressive brownfield exploration and land package expansion at existing sites are likely to extend mine life and expand reserves, supporting sustained long-term production and reducing future earnings volatility.

Coeur Mining Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Coeur Mining's revenue will grow by 12.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 13.1% today to 32.3% in 3 years time.

- Analysts expect earnings to reach $676.1 million (and earnings per share of $0.69) by about September 2028, up from $190.7 million today. However, there is a considerable amount of disagreement amongst the analysts with the most bullish expecting $1.1 billion in earnings, and the most bearish expecting $485 million.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 18.8x on those 2028 earnings, down from 47.1x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.7x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.37%, as per the Simply Wall St company report.

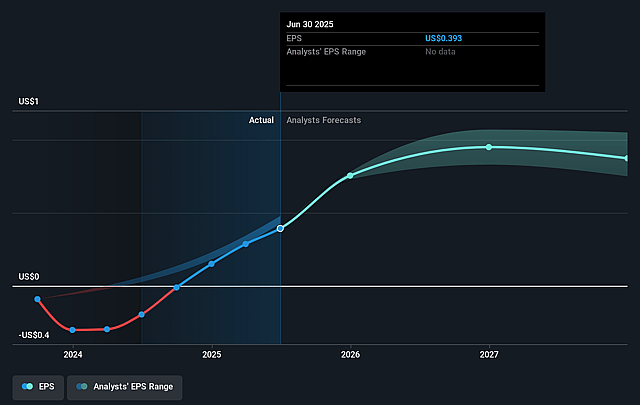

Coeur Mining Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Expectations for higher regulatory and permitting hurdles, especially highlighted by the multi-year Silvertip development process and emphasis on not cutting corners, may extend lead times for new asset development and expansion, potentially delaying growth projects and revenue realization.

- The company's reliance on existing reserves and need for ongoing infill and expansion drilling to maintain or extend mine life, especially at Las Chispas and other key assets, presents a risk of production declines should exploration fail to replace depletion, which could negatively impact long-term revenue and earnings stability.

- Exposure to currency fluctuations (e.g., significant impact of the strong Mexican peso on costs and taxation) introduces cost volatility and could erode net margins if adverse foreign exchange moves persist.

- Coeur's high capital intensity, as seen in substantial investments at Rochester and Las Chispas as well as legacy acquisition-related amortization and deferred tax liabilities, may pressure cash flows and lead to higher non-cash expenses, reducing reported net income over time.

- Regional and jurisdictional risks, including potential resource nationalism, changing tax regimes, and environmental permitting delays in the U.S., Mexico, and Canada, could increase operating costs, cause project delays, or disrupt production, all of which would impact long-term profitability and cash flow.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $13.083 for Coeur Mining based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $14.5, and the most bearish reporting a price target of just $12.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $2.1 billion, earnings will come to $676.1 million, and it would be trading on a PE ratio of 18.8x, assuming you use a discount rate of 7.4%.

- Given the current share price of $13.97, the analyst price target of $13.08 is 6.8% lower. The relatively low difference between the current share price and the analyst consensus price target indicates that they believe on average, the company is fairly priced.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Coeur Mining?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.

Read more narratives