Last Update 01 Nov 25

Fair value Decreased 3.16%Analysts have reduced Century Aluminum’s fair value estimate by $1.00 to $30.67 per share, citing shifting aluminum price trends, slightly higher discount rates, and recent research highlighting both supportive tariffs as well as stronger-than-expected demand in China.

Analyst Commentary

Industry experts have weighed in on Century Aluminum’s outlook, leading to new research coverage and updated valuations. The commentary reflects both optimism about the company’s growth catalysts and cautions about market challenges.

Bullish Takeaways

- Bullish analysts point to robust demand in China, which continues to drive aluminum prices higher and supports broader revenue growth for Century Aluminum.

- Price targets have been raised recently, reflecting confidence in Century's ability to benefit from supportive trade policies, including significant import tariffs that protect U.S. producers.

- Firm coverage initiations with positive ratings reflect expectations for Century to outperform, particularly as recent market performance has exceeded earlier forecasts.

- Updates to forward price curves and the company’s ability to secure favorable pricing are seen as strengthening near-term valuation prospects.

Bearish Takeaways

- Bearish analysts flag weaker business trends in the U.S. and European Union, which could limit Century’s volume growth outside China.

- Increased discount rates are being applied, which may weigh on the company’s longer-term fair value estimates.

- While tariffs are a tailwind for now, reliance on them introduces policy risk if trade dynamics change.

- Volatility in global aluminum prices poses ongoing risks to forecast certainty and profitability.

What's in the News

- U.S. President Trump reversed a Biden-era pollution rule that imposed stricter limits on copper smelter emissions. This change grants a two-year compliance exemption for affected companies, including Century Aluminum (Reuters).

- Canada will remove many retaliatory tariffs on U.S. products but is likely to keep 25% duties on U.S. steel and aluminum imports. This will impact companies like Century Aluminum (Bloomberg).

- The Trump administration expanded tariffs on steel and aluminum imports by adding 407 derivative product codes. This increases the scope of trade protections for domestic producers such as Century Aluminum (Reuters).

Valuation Changes

- The Fair Value Estimate has decreased slightly from $31.67 to $30.67 per share.

- The Discount Rate has risen modestly from 7.83% to 7.92%.

- The Revenue Growth forecast has edged down marginally from 7.57% to 7.56%.

- The Net Profit Margin has increased minimally from 18.27% to 18.28%.

- The Future P/E ratio has declined from 6.75x to 6.55x.

Key Takeaways

- Expansion of U.S. production and operational efficiency improvements position the company to benefit from rising demand and favorable market conditions.

- Government incentives and strong end-market trends support revenue growth, margin expansion, and enhanced financial flexibility for future initiatives.

- Heavy reliance on favorable market conditions, government support, and stable input costs exposes the company to significant operational, regulatory, and competitive risks that threaten profitability.

Catalysts

About Century Aluminum- Produces and sells standard-grade and value-added primary aluminum products in the United States and Iceland.

- The expansion and restart of Mt. Holly, along with progress on a new U.S. smelter, positions Century Aluminum to meaningfully increase U.S. primary aluminum production, capturing rising domestic demand driven by reshoring of supply chains and incentivized by government tariffs and trade protections-supporting future revenue growth and improved fixed cost absorption, thus enhancing net margins.

- Expected sustained tightness in global primary aluminum supply (with China near capacity caps and minimal new ex-China projects) should maintain favorable pricing levels and strong Midwest premiums, especially as U.S. demand rebounds from infrastructure and electrification trends, providing a tailwind for top-line growth and improved EBITDA.

- The company's investments in operational efficiency-evident in safety initiatives and planned capital improvements, such as the Jamalco steam turbine upgrade-support further margin expansion by lowering energy and operating costs, translating into stronger future earnings.

- Continued momentum in end-market demand (especially value-added products like billets for transportation electrification and the growing use of aluminum in clean energy and sustainable packaging) is driving higher premiums and increased shipment volumes, directly benefiting revenue visibility and margin expansion.

- Receipt of substantial U.S. manufacturing tax credits (45X credits) tied to domestic production volumes-expected to grow with the Mt. Holly restart and potential new smelter-should significantly enhance future free cash flow and net income, providing financial flexibility for additional growth initiatives.

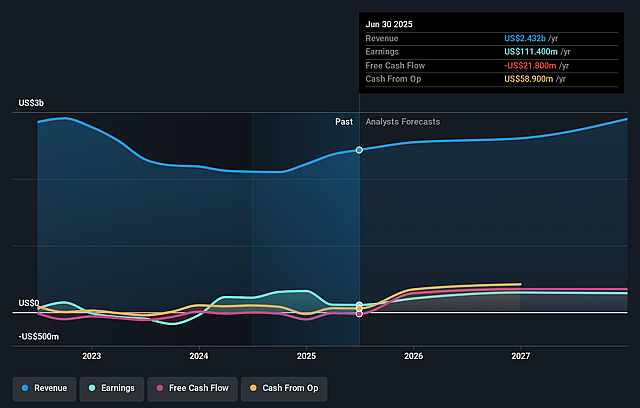

Century Aluminum Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Century Aluminum's revenue will grow by 7.6% annually over the next 3 years.

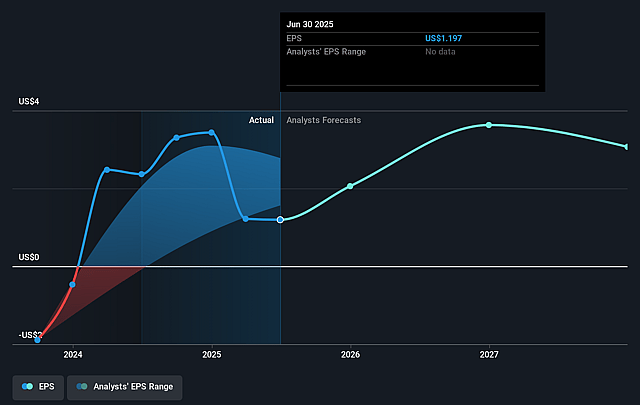

- Analysts assume that profit margins will increase from 4.6% today to 15.8% in 3 years time.

- Analysts expect earnings to reach $479.3 million (and earnings per share of $3.88) by about September 2028, up from $111.4 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 6.7x on those 2028 earnings, down from 18.2x today. This future PE is lower than the current PE for the US Metals and Mining industry at 22.5x.

- Analysts expect the number of shares outstanding to grow by 0.58% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.9%, as per the Simply Wall St company report.

Century Aluminum Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Century's financial performance and positive outlook are currently heavily dependent on high U.S. Midwest aluminum premiums and the continued effectiveness of Section 232 tariffs; a future policy change-such as removal or lowering of tariffs-would likely reduce domestic premiums and demand, pressuring both revenues and net margins.

- The company's ambitious investment in expanding production capacity at Mt. Holly and planning a new smelter exposes it to significant execution risk, including potential delays or cost overruns, which could materially increase capital expenditures and reduce free cash flow and overall profitability.

- Century remains highly exposed to volatility in raw material and energy costs (like alumina, coke, power), with periods of elevated or unpredictable prices capable of sharply increasing operating expenses and compressing EBITDA margins-particularly given the energy-intensive nature of its smelting operations.

- Dependence on government incentives and industrial power contracts (e.g., with Santee Cooper at Mt. Holly) introduces uncertainty; changes to these incentives, power availability/cost, or regulatory frameworks could negatively affect long-term cost structures and erode net margins.

- Weakening premiums and sluggish demand in the European market, ongoing currency headwinds, and continued global competition from low-cost producers (especially from China and the Middle East) create long-term risks of margin compression and lower revenue growth abroad, making Century's global earnings less predictable.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $27.0 for Century Aluminum based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $3.0 billion, earnings will come to $479.3 million, and it would be trading on a PE ratio of 6.7x, assuming you use a discount rate of 7.9%.

- Given the current share price of $21.74, the analyst price target of $27.0 is 19.5% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.