Last Update16 Oct 25Fair value Decreased 3.31%

Analysts have lowered their fair value estimate for AppFolio to $330.20 from $341.50. This change reflects improved sentiment around market expansion and resident services opportunities, but also includes a modest adjustment in long-term growth and margin assumptions.

Analyst Commentary

Recent analyst activity around AppFolio has reflected evolving views on the company's growth prospects and execution, with several target price revisions and rating upgrades in response to both strategic developments and market opportunities.

Bullish Takeaways- Bullish analysts cite growing momentum in net new customer wins and expansions within the Plus and Max offerings. They highlight AppFolio's potential to scale across segments.

- There is increased confidence in the firm's expanding total addressable market, particularly through robust opportunities to monetize the resident experience.

- Optimism persists around the positive near-term impact of resident services initiatives. This could further support valuation and share price performance.

- Several analysts have upgraded AppFolio's rating or raised price targets, signaling improved conviction in the company’s ability to capitalize on its market expansion and innovation strategies.

- Bearish analysts exercise caution regarding long-term margin assumptions. While recent growth has been positive, sustainable margin improvement remains a key execution risk.

- Some caution exists around the pace at which AppFolio can effectively monetize its broader resident service opportunities, with execution risk tied to scaling new initiatives.

- Despite increased optimism, valuation concerns remain as share price appreciation may run ahead of fundamental improvements in growth and profitability metrics.

What's in the News

- KeyBanc upgraded AppFolio to Overweight from Sector Weight with a $285 price target. The upgrade reflects renewed confidence in momentum from net new customer wins and product expansions. (KeyBanc research note)

- AppFolio unveiled Real Estate Performance Management at its FUTURE conference, introducing a performance-driven platform and new Resident Onboarding innovations to enhance both resident satisfaction and property operator outcomes. (Company announcement)

- Tim Eaton, previously Interim CFO, has been officially appointed Chief Financial Officer. He brings extensive leadership experience from within AppFolio and prior roles at major financial institutions. (Company announcement)

- AppFolio completed a share repurchase of 243,987 shares, amounting to 0.69% of outstanding shares for $49.96 million, as part of its ongoing buyback program. (Company announcement)

- The company issued fiscal year 2025 guidance and projects full-year revenue between $935 million and $945 million. (Company announcement)

Valuation Changes

- The Fair Value Estimate has decreased from $341.50 to $330.20, reflecting a modest adjustment based on revised long-term assumptions.

- The Discount Rate has risen slightly from 8.40% to 8.43%, indicating a marginally higher perceived risk in future cash flow projections.

- The Revenue Growth projection has increased from 17.66% to 17.70%, suggesting a minor upward revision in expected sales expansion.

- The Net Profit Margin is now forecast at 13.70%, up from 13.67%, representing a slight improvement in profitability expectations.

- The Future P/E Ratio has fallen from 79.28x to 76.49x, reflecting a more modest valuation multiple based on the updated earnings outlook.

Key Takeaways

- Rising AI adoption and digital transformation in property management strengthen AppFolio's customer acquisition, platform engagement, and long-term revenue prospects.

- Integrated ecosystem partnerships and investment in high-margin services increase platform stickiness, recurring revenue, and operational efficiency.

- Competitive pressures, regulatory risks, reliance on domestic growth, rising innovation costs, and exposure to third-party threats could constrain future revenue, margins, and differentiation.

Catalysts

About AppFolio- Provides cloud-based platform for the real estate industry in the United States.

- Accelerating adoption of AI-powered workflow automation within property management-demonstrated by a 46% increase in industry intent to use AI and 96% of customers engaging with AI solutions-positions AppFolio to continue expanding unit counts, drive top-line revenue growth, and support future increases in net margins through productivity gains.

- Expansion of integrated ecosystem partnerships (e.g., AppFolio Stack, fintech solutions, and third-party partner integrations) provides customers with more seamless, end-to-end experiences, increasing the platform's stickiness, ARPU, and recurring revenue potential.

- Elevated labor shortages and ongoing economic pressures in real estate are driving property management customers to adopt technology for cost reduction and efficiency, supporting consistent customer acquisition and minimizing churn, which will have a positive impact on revenue and retention rates.

- The growing shift toward digital transformation and cloud-based SaaS across the industry expands AppFolio's addressable market, fueling sustained customer growth, higher subscription sales, and potential long-term earnings expansion.

- Sustained investment in high-margin, value-added services-such as advanced screening (FolioScreen), payment processing, and insurance-alongside continued operational efficiency is expected to further increase net margins and support profitable revenue growth.

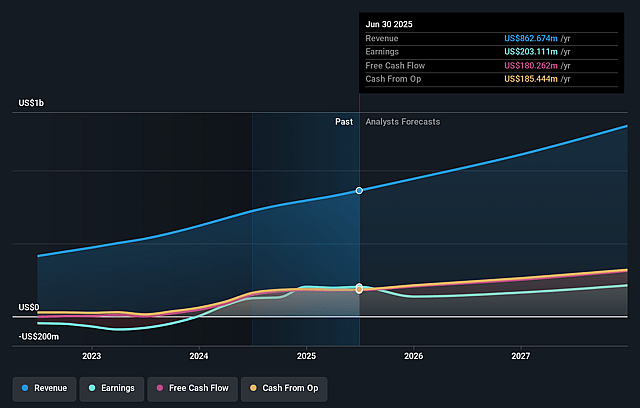

AppFolio Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming AppFolio's revenue will grow by 17.7% annually over the next 3 years.

- Analysts assume that profit margins will shrink from 23.5% today to 13.7% in 3 years time.

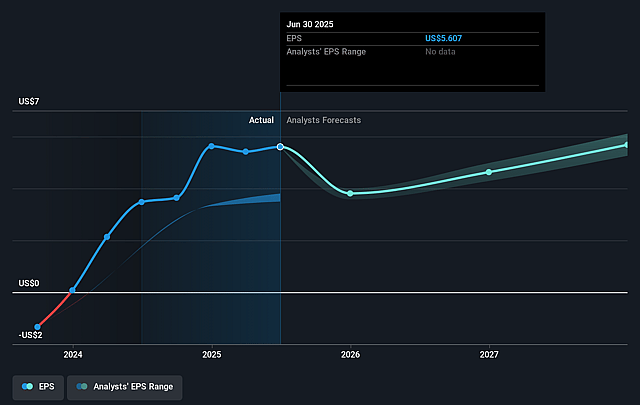

- Analysts expect earnings to reach $192.0 million (and earnings per share of $5.68) by about September 2028, down from $203.1 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 79.3x on those 2028 earnings, up from 49.4x today. This future PE is greater than the current PE for the US Software industry at 36.2x.

- Analysts expect the number of shares outstanding to decline by 0.17% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 8.4%, as per the Simply Wall St company report.

AppFolio Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Customer growth primarily comes from new business wins and increased adoption of premium tiers within an already competitive property management segment, which may face commoditization and pricing pressure as more providers develop similar AI-powered SaaS offerings-risking future revenue growth and margin expansion as customers gain greater bargaining power.

- The company's focus remains overwhelmingly domestic, with no mention of international expansion initiatives, implying a limited addressable market; if industry growth slows or saturates in the U.S., future revenue and earnings growth could be capped as the core customer base matures.

- Heavy investment in product innovation (especially AI features) requires continually rising R&D and go-to-market spend; if competitors develop or offer comparable automation and agentic technologies, AppFolio's differentiation could erode, leading to margin pressures and slower operating leverage improvements.

- Major revenue drivers like screening, payments, and risk mitigation services rely on increasing compliance complexity and data handling; rising regulatory scrutiny and new privacy legislation could require expensive platform overhauls and increase compliance costs, directly impacting net margins.

- Partnerships with fintech and third-party integrations are becoming central to the platform's value proposition, exposing AppFolio to third-party risk (including data security) and greater competitive overlap; any significant cybersecurity incident or loss of integration partners could negatively impact customer trust, retention rates, and long-term revenue stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $341.5 for AppFolio based on their expectations of its future earnings growth, profit margins and other risk factors.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $1.4 billion, earnings will come to $192.0 million, and it would be trading on a PE ratio of 79.3x, assuming you use a discount rate of 8.4%.

- Given the current share price of $279.59, the analyst price target of $341.5 is 18.1% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.