Last Update 15 Jan 26

Fair value Decreased 4.06%CNXC: Higher Discount Rate Reset Will Support Future Undervalued Entry Thesis

Analysts have trimmed their price target on Concentrix by about $2.63, citing updated assumptions on fair value, discount rate, revenue growth, profit margin and future P/E following recent research that included a $4 reduction highlighted at Baird.

Analyst Commentary

Analysts framing the new price target are trying to line up their fair value work with updated assumptions on discount rates, revenue growth, margins and the future P/E they think the market is willing to pay for Concentrix.

That recalibration has produced both optimistic and cautious talking points that matter for anyone tracking the stock.

Bullish Takeaways

- Bullish analysts see the reset price target as a cleaner entry framework, with fair value now tied more tightly to refreshed cash flow and earnings assumptions rather than older, less current models.

- The updated future P/E assumptions suggest some believe Concentrix can still justify a valuation that reflects ongoing execution, even once higher discount rates and more conservative growth inputs are included in the analysis.

- Supporters view the modest size of the trim, including the highlighted US$4 cut, as a sign that the core long term thesis on the business model remains intact in their work.

- Some bullish views treat the revised target as a way to reduce expectations risk, arguing that a more grounded fair value can make future operational progress easier for the stock to track.

Bearish Takeaways

- Bearish analysts are emphasizing higher discount rate assumptions, which reduce present value estimates and indicate more caution around how future cash flows should be priced.

- There is added scrutiny on revenue growth and profit margin inputs, with cautious analysts building in less generous scenarios that, in their models, cap the upside for earnings and the justified P/E.

- The lower target price reflects concern that prior fair value work may have been too optimistic on execution and that investors should factor in a wider range of outcomes.

- Some cautious views highlight that if the future P/E ends up lower than previously assumed, it could limit how much multiple expansion can contribute to returns, even if operations hold steady.

What's in the News

- Completed share repurchase of 1,300,000 shares, or 2.09% of outstanding, between September 1 and November 30, 2025 for US$55.22m. This brings total buybacks under the September 27, 2021 program to 7,422,276 shares, or 12.27%, for US$513.47m (company buyback update).

- Issued unaudited earnings guidance for Q1 ending February 28, 2026, with reported revenue expected between US$2.475b and US$2.5b and operating income between US$139.5m and US$149.5m (corporate guidance).

- For the full year ending November 30, 2026, provided unaudited guidance for reported revenue between US$10.035b and US$10.18b and operating income between US$687.5m and US$737.5m (corporate guidance).

- Announced a new suite of pre built, emotionally aware conversational AI agents that handle tasks like product support, order tracking, appointment scheduling and collections, built on the company's Agentic Operating Framework and iX Hello platform (product announcement).

- Highlighted Nespresso as a partner using Concentrix conversational AI technologies to support brand experience across different cultures and languages, with a focus on secure and trustworthy AI aligned with ISO standards (product announcement).

Valuation Changes

- Fair Value: revised from US$64.83 to US$62.20, representing a small reduction in the modeled target level.

- Discount Rate: adjusted from 10.20% to 10.77%, reflecting a slightly higher required return in the models.

- Revenue Growth: moved from 3.15% to 3.01%, indicating a modestly more conservative assumption on top line expansion.

- Net Profit Margin: reset from 3.40% to 9.34%, showing a very large step up in modeled profitability.

- Future P/E: shifted from 12.90x to 4.55x, marking a significant cut to the multiple analysts are using to value future earnings.

Key Takeaways

- Integrating AI solutions and iX Hello products is expected to drive revenue growth and earnings by enhancing client offerings and operational efficiency.

- The Webhelp acquisition synergies, capital allocation, and share repurchases aim to improve margins and EPS, supporting profitability and shareholder returns.

- Concentrix's growth and profitability are at risk due to modest revenue growth, integration challenges, currency risks, high debt, and client concentration issues.

Catalysts

About Concentrix- Designs, builds, and runs integrated customer experience (CX) solutions worldwide.

- Concentrix is focusing on integrating AI solutions across its operations and client offerings, which is expected to drive revenue growth as it becomes a trusted provider for AI solutions in the market. The adoption of its GenAI platforms is positioned to increase revenue by expanding the share of wallet with current clients.

- The company is monetizing its iX Hello products, designed to be accretive to earnings by the end of fiscal 2025. The transition from pilot phases to deployments is expected to positively impact earnings growth.

- Concentrix is experiencing revenue growth from partner consolidation. By expanding its business solutions and becoming a leading provider of integrated AI and business services, it is positioned to capture more client spending, impacting revenue and potentially improving net margins due to increased efficiency.

- The synergies from the Webhelp acquisition and integration are expected to yield margin expansion, with anticipated savings boosting non-GAAP operating margins over time. This contributes to both profitability and cash flow improvements.

- Concentrix’s capital allocation strategy involves share repurchases, which are likely to enhance EPS as the company takes advantage of perceived undervaluation. This strategy also includes investing for long-term growth while managing debt, enhancing net margins, and maintaining shareholder returns.

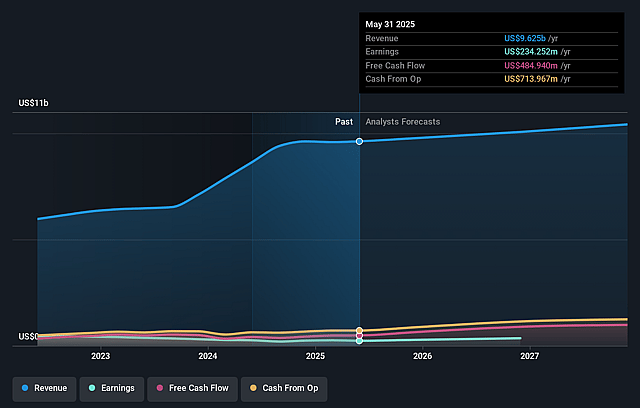

Concentrix Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming Concentrix's revenue will grow by 3.2% annually over the next 3 years.

- Analysts assume that profit margins will increase from 2.4% today to 4.8% in 3 years time.

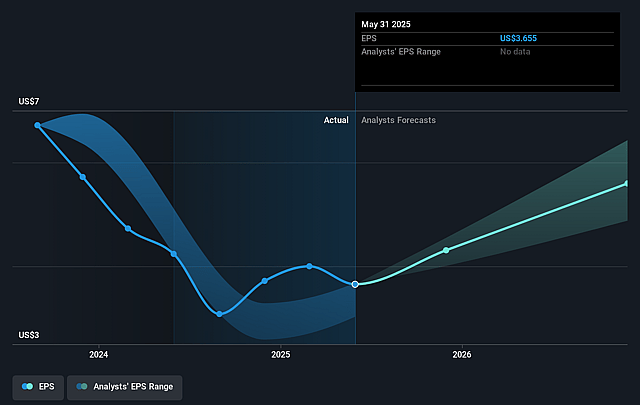

- Analysts expect earnings to reach $509.6 million (and earnings per share of $8.19) by about September 2028, up from $234.3 million today. The analysts are largely in agreement about this estimate.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 10.1x on those 2028 earnings, down from 14.4x today. This future PE is lower than the current PE for the US Professional Services industry at 26.3x.

- Analysts expect the number of shares outstanding to decline by 2.77% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 10.22%, as per the Simply Wall St company report.

Concentrix Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Although Concentrix experienced a modest revenue growth of 1.3% year-over-year, a low growth rate could indicate potential challenges in maintaining or accelerating revenue growth, particularly if macroeconomic conditions do not improve, impacting future revenues.

- The pressure to integrate and harmonize Webhelp's operations and synergies could lead to increased costs and potential disruptions if not managed effectively. This could impact operating margins and net income if anticipated synergies are not realized timely.

- Concentrix faces potential currency exchange rate risks, with ongoing revenue guidance assuming up to a 135 basis point negative impact on full-year results. This could affect both reported revenues and net earnings.

- The company has a significant debt burden, with total debt standing at $4.9 billion. Rising interest rates or refinancing challenges could increase interest expenses, affecting net income and cash flow available for dividends or reinvestment.

- Dependence on a limited number of top clients, whose revenue growth outpaces the rest of the business, presents concentration risk. Any downturn in a major client's business could materially affect Concentrix's revenue and profitability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $67.667 for Concentrix based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $80.0, and the most bearish reporting a price target of just $61.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $10.6 billion, earnings will come to $509.6 million, and it would be trading on a PE ratio of 10.1x, assuming you use a discount rate of 10.2%.

- Given the current share price of $53.56, the analyst price target of $67.67 is 20.8% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

Have other thoughts on Concentrix?

Create your own narrative on this stock, and estimate its Fair Value using our Valuator tool.

Create NarrativeHow well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.