Last Update 10 Dec 25

Fair value Increased 0.0041%EGP: Future Industrial Leasing Strength Will Offset Slower Development And Support Earnings Stability

EastGroup Properties' analyst price target has inched higher to approximately $193.85 per share from about $193.84, as analysts point to a solid Q3 earnings season for REITs, strengthening industrial leasing fundamentals, and updated models that reflect a favorable multi year growth runway and improved private market valuations.

Analyst Commentary

Recent Street research reflects a generally constructive stance on EastGroup Properties, with multiple bullish analysts lifting price targets into the high $180s to low $200s on the back of solid execution and an extended growth runway.

Bullish Takeaways

- Bullish analysts are raising price targets to the $188 to $207 range, signaling confidence that current valuation still offers upside relative to projected earnings and net asset value growth.

- Q3 performance is being characterized as solid, with updated models pointing to a favorable multi year growth trajectory supported by resilient industrial demand and improving private market valuations.

- Several research updates highlight strengthening industrial leasing fundamentals, which are expected to support sustained rent growth and embedded cash flow expansion, reinforcing the long term investment case.

- Management's consistent delivery on guidance and earnings is viewed as a key differentiator, underpinning premium valuation multiples and justifying higher target prices despite macro uncertainty.

Bearish Takeaways

- Bearish analysts point to a slower development leasing pace and a reduced full year development start target, which could temper near term growth in earnings and net asset value.

- The latest quarter, while solid fundamentally, was seen by some as lackluster versus elevated expectations, raising questions about upside surprise potential from here.

- Despite modest target price increases, more cautious views maintain lower relative valuation expectations, reflecting concern that momentum in development and leasing may not fully match bullish projections.

- Some research notes flag that stock performance has not kept pace with reported fundamentals, suggesting execution needs to remain strong to close the gap between trading levels and revised targets.

What's in the News

- Filed a new at-the-market follow-on equity shelf for up to $1 billion in common stock, providing additional financial flexibility for development and acquisition opportunities (Key Developments).

- Completed multiple tranches of at-the-market common stock offerings totaling approximately $520.1 million, including several income trust structured issuances at prices in the mid to high $170s and low $180s per share (Key Developments).

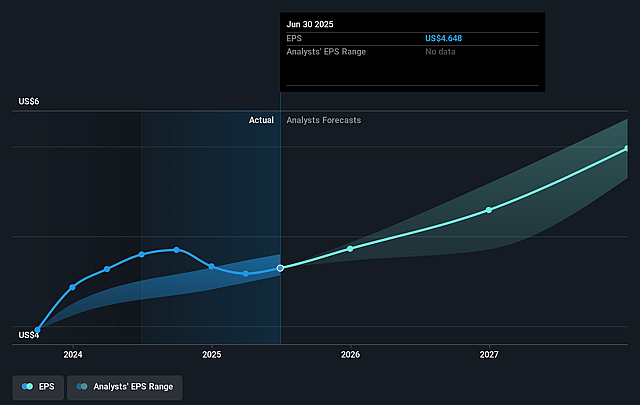

- Issued 2025 earnings guidance projecting fourth quarter net income attributable to common stockholders of $66.6 million to $68.7 million, or $1.25 to $1.29 per diluted share (Key Developments).

- For full year 2025, guided to net income attributable to common stockholders of $256.3 million to $258.4 million, or $4.85 to $4.89 per diluted share (Key Developments).

Valuation Changes

- The Fair Value Estimate has risen slightly to approximately $193.85 per share from about $193.84, implying a marginally higher intrinsic valuation.

- The Discount Rate has fallen slightly from roughly 8.49 percent to about 8.49 percent, reflecting a modestly lower implied cost of capital in updated models.

- Revenue growth has edged down slightly from about 10.22 percent to roughly 10.16 percent, indicating a small reduction in forward top line growth assumptions.

- The Net Profit Margin has risen slightly from approximately 37.25 percent to about 37.41 percent, suggesting a modest improvement in expected profitability.

- The future P/E has declined slightly from about 40.64x to roughly 40.52x, indicating a marginally lower multiple applied to projected earnings.

Key Takeaways

- Growing demand in Sunbelt markets and limited new supply support strong pricing power and earnings growth for EastGroup's logistics-focused portfolio.

- Strategic expansion and a robust balance sheet position the company to capitalize on long-term economic and e-commerce-driven tailwinds.

- Reliance on select regions facing economic, regulatory, and climate headwinds threatens revenue growth, rental performance, and earnings stability while constrained capital access limits future development.

Catalysts

About EastGroup Properties- EastGroup Properties, Inc. (NYSE: EGP), a member of the S&P Mid-Cap 400 and Russell 2000 Indexes, is a self-administered equity real estate investment trust focused on the development, acquisition and operation of industrial properties in high-growth markets throughout the United States with an emphasis in the states of Texas, Florida, California, Arizona and North Carolina.

- Structural US population growth and migration to Sunbelt markets continues to underpin robust demand for modern industrial/logistics properties, directly benefiting EastGroup's core portfolio and positioning the company for sustained revenue and NOI growth as these regions outpace national averages.

- Persistent e-commerce expansion and ongoing supply chain modernization are ensuring elevated leasing spreads and high occupancy in EastGroup's infill, last-mile logistics facilities, supporting above-average rental rate growth and driving resilient net margins.

- Industry-wide constraints on new supply-stemming from ongoing zoning and land scarcity-are enabling EastGroup to maintain its pricing power and consistently high utilization, even in a more cautious capital environment, supporting stable and potentially accelerating earnings growth as macro uncertainty dissipates.

- EastGroup's strategic expansion in high-barrier, technology-driven Sunbelt metros (like Raleigh, Nashville, and Austin) is leveraging long-term regional economic tailwinds, increasing portfolio quality and diversification, and supporting long-term asset appreciation and NAV growth.

- Management's strong balance sheet, ample land bank, and ability to accelerate development starts when demand rebounds ensures the company can capitalize early on secular demand trends, translating to scalable FFO growth and further upside in earnings as market sentiment normalizes.

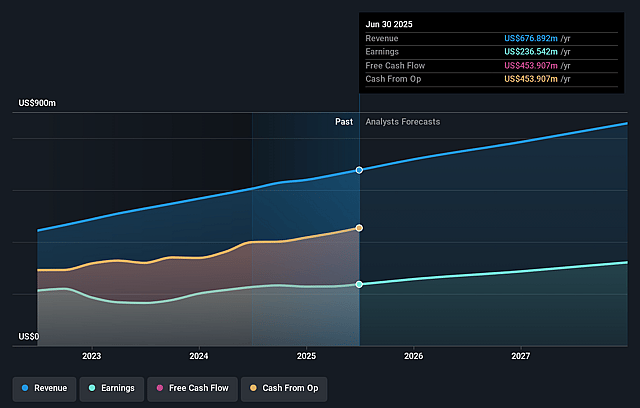

EastGroup Properties Future Earnings and Revenue Growth

Assumptions

How have these above catalysts been quantified?- Analysts are assuming EastGroup Properties's revenue will grow by 10.8% annually over the next 3 years.

- Analysts assume that profit margins will increase from 34.9% today to 36.9% in 3 years time.

- Analysts expect earnings to reach $339.7 million (and earnings per share of $6.23) by about September 2028, up from $236.5 million today.

- In order for the above numbers to justify the analysts price target, the company would need to trade at a PE ratio of 45.3x on those 2028 earnings, up from 37.1x today. This future PE is greater than the current PE for the US Industrial REITs industry at 26.9x.

- Analysts expect the number of shares outstanding to grow by 7.0% per year for the next 3 years.

- To value all of this in today's terms, we will use a discount rate of 7.95%, as per the Simply Wall St company report.

EastGroup Properties Future Earnings Per Share Growth

Risks

What could happen that would invalidate this narrative?- Prolonged uncertainty and slow decision-making among larger tenants, particularly due to ongoing tariff and geopolitical issues, has resulted in lengthened development leasing timelines and reduced development starts, which could weigh on both revenue growth and near-term earnings scalability.

- Exposure to markets such as Southern California and other regions experiencing multiple consecutive quarters of negative net absorption has increased the need for rent concessions and more aggressive pricing, negatively impacting rent growth and net margins from those assets.

- Persistent high interest rates and limited differentiation between the cost of debt and equity may constrain access to affordable capital, compress valuation multiples, and potentially limit EastGroup's ability to fund new developments or acquisitions, affecting long-term FFO growth.

- Concentrated exposure in select Sunbelt and Western/Southern US markets, some of which (e.g., California, Phoenix) are increasingly facing climate risk, water scarcity, and regulatory headwinds, reduces geographic diversification and could adversely affect occupancy, rental growth, and property values over time.

- Tenant health in certain regions-especially California-remains an above-average risk, as a disproportionate share of bad debt write-offs are concentrated there; rising property taxes, insurance, and higher vacancy in these regions could compress net operating income and earnings stability.

Valuation

How have all the factors above been brought together to estimate a fair value?- The analysts have a consensus price target of $188.278 for EastGroup Properties based on their expectations of its future earnings growth, profit margins and other risk factors. However, there is a degree of disagreement amongst analysts, with the most bullish reporting a price target of $218.0, and the most bearish reporting a price target of just $174.0.

- In order for you to agree with the analyst's consensus, you'd need to believe that by 2028, revenues will be $921.3 million, earnings will come to $339.7 million, and it would be trading on a PE ratio of 45.3x, assuming you use a discount rate of 8.0%.

- Given the current share price of $164.92, the analyst price target of $188.28 is 12.4% higher.

- We always encourage you to reach your own conclusions though. So sense check these analyst numbers against your own assumptions and expectations based on your understanding of the business and what you believe is probable.

How well do narratives help inform your perspective?

Disclaimer

AnalystConsensusTarget is a tool utilizing a Large Language Model (LLM) that ingests data on consensus price targets, forecasted revenue and earnings figures, as well as the transcripts of earnings calls to produce qualitative analysis. The narratives produced by AnalystConsensusTarget are general in nature and are based solely on analyst data and publicly-available material published by the respective companies. These scenarios are not indicative of the company's future performance and are exploratory in nature. Simply Wall St has no position in the company(s) mentioned. Simply Wall St may provide the securities issuer or related entities with website advertising services for a fee, on an arm's length basis. These relationships have no impact on the way we conduct our business, the content we host, or how our content is served to users. The price targets and estimates used are consensus data, and do not constitute a recommendation to buy or sell any stock, and they do not take account of your objectives, or your financial situation. Note that AnalystConsensusTarget's analysis may not factor in the latest price-sensitive company announcements or qualitative material.